Cablevision 2014 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

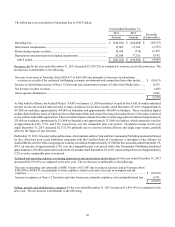

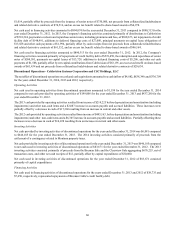

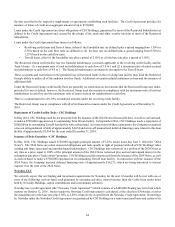

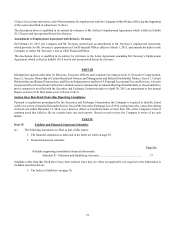

Debt Outstanding

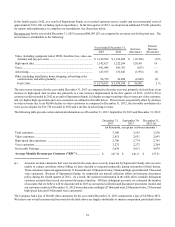

The following table summarizes our outstanding debt (excluding accrued interest), including capital lease obligations, as well as

interest expense and capital expenditures as of and for the year ended December 31, 2014:

Restricted

Group Newsday

LLC (a) Other

Entities

Total

CSC

Holdings Cablevision Eliminations (b) Total

Cablevision

Credit facility debt .. $ 2,300,649 $ 480,000 $ — $ 2,780,649 $ — $ — $ 2,780,649

Senior notes and

debentures............ 3,062,126 — — 3,062,126 3,405,196 (611,455) 5,855,867

Collateralized

indebtedness

relating to stock

monetizations....... — — 986,183 986,183 — — 986,183

Capital lease

obligations ........... 45,980 432 — 46,412 — — 46,412

Notes payable.......... 23,911 — — 23,911 — — 23,911

Total debt.............. $ 5,432,666 $ 480,432 $ 986,183 $ 6,899,281 $ 3,405,196 $ (611,455) $ 9,693,022

Interest expense....... $ 288,216 $ 18,860 $ 46,212 $ 353,288 $ 270,766 $ (48,054) $ 576,000

Capital expenditures $ 874,099 $ 5,816 $ 11,763 $ 891,678 $ — $ — $ 891,678

(a) CSC Holdings has guaranteed Newsday LLC's obligation under its credit facility, which amounted to $480,000 at

December 31, 2014. For purposes of the Restricted Group credit facility and indentures, guarantees are treated as

indebtedness. The total debt for the Restricted Group reflected in the table above does not include the $480,000 guarantee.

(b) Represents the elimination of the senior notes issued by Cablevision and held by Newsday Holdings.

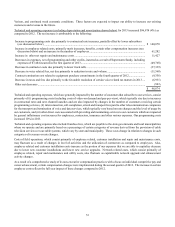

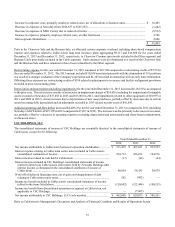

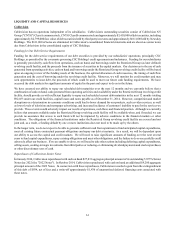

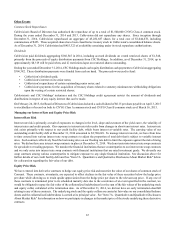

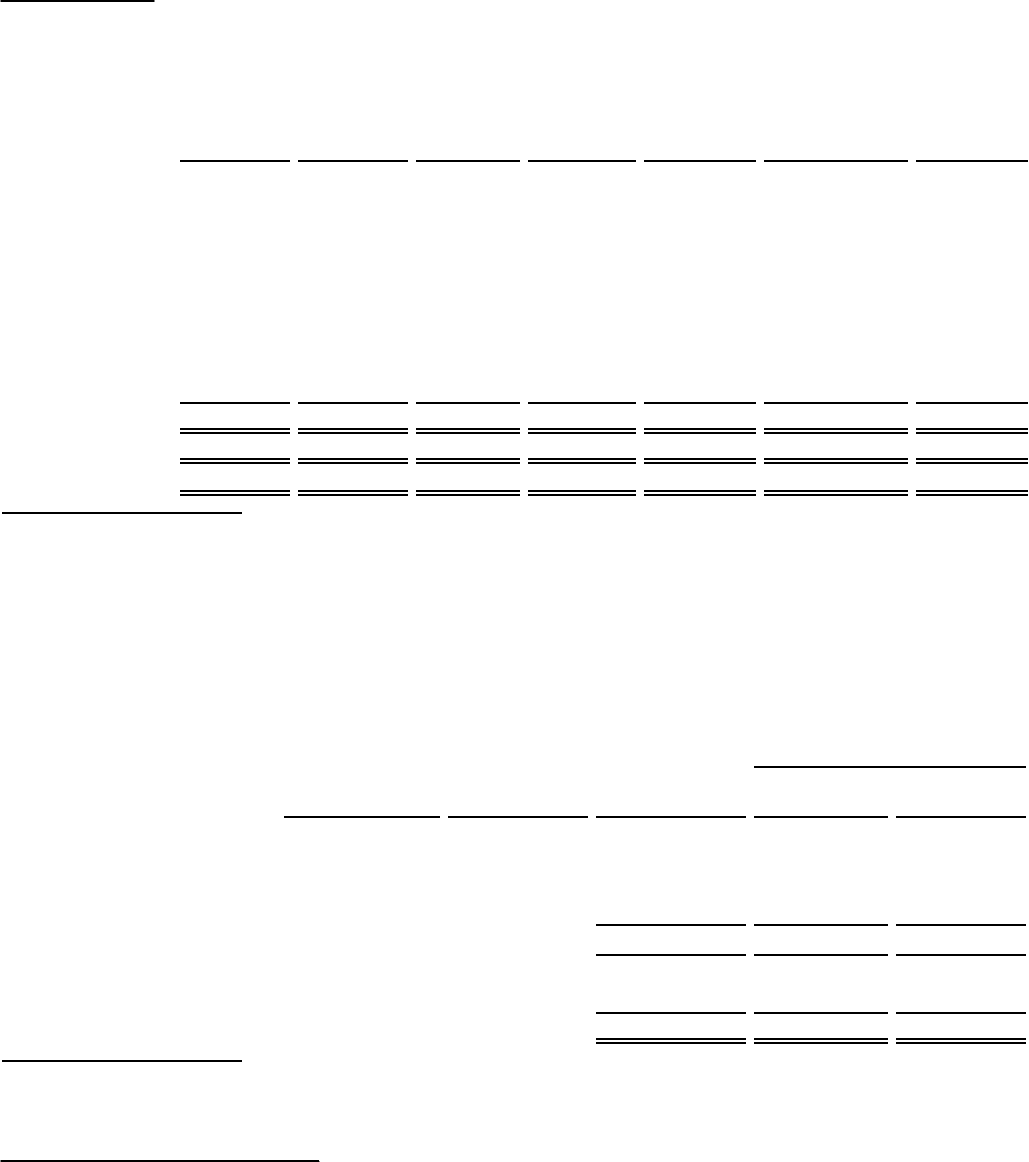

The following table provides details of our outstanding credit facility debt:

Interest

Rate at

Amounts

Payable

on or prior to Carrying Value at

Maturity

Date December 31,

2014 December 31,

2015 December 31,

2014 December 31,

2013

Restricted Group:

Revolving loan facility................. April 17, 2018 — $ — $ — $ —

Term A loan facility..................... April 17, 2018 1.92% 47,926 934,547 958,510

Term B loan facility (a)................ April 17, 2020 2.67% 13,923 1,366,102 2,327,635

Restricted Group credit facility debt...................................................... 61,849 2,300,649 3,286,145

Newsday floating rate term loan

facility....................................... October 12, 2016 3.67% — 480,000 480,000

Total credit facility debt......................................................................... $ 61,849 $ 2,780,649 $ 3,766,145

(a) The unamortized discount related to the Term B loan facility amounted to $5,326 and $10,615 at December 31, 2014 and

2013, respectively.

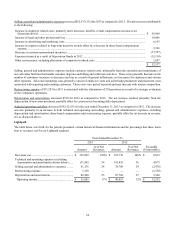

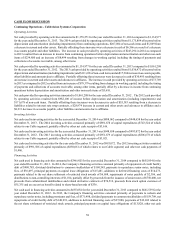

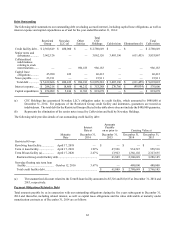

Payment Obligations Related to Debt

Total amounts payable by us in connection with our outstanding obligations during the five years subsequent to December 31,

2014 and thereafter, including related interest, as well as capital lease obligations and the value deliverable at maturity under

monetization contracts as of December 31, 2014 are as follows: