Cablevision 2014 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except share and per share amounts)

F-31

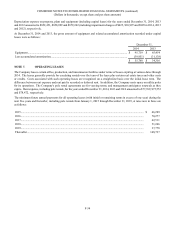

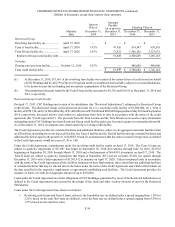

elimination of 59 positions at Newsday. The 2013 and 2012 restructuring credits primarily related to changes to the Company's

previous estimates recorded in connection with the Company's prior restructuring plans.

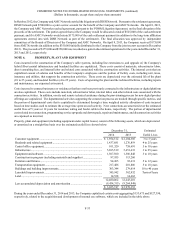

Impairment Charges

Goodwill and indefinite-lived intangible assets are tested annually for impairment during the first quarter of each year or earlier

upon the occurrence of certain events or substantive changes in circumstances. As a result of the continuing deterioration of values

in the newspaper industry and competition from other media and its current and anticipated impact on Newsday's advertising

business, the Company determined that a triggering event had occurred at the Newsday reporting unit and the Company tested

Newsday's indefinite-lived intangibles and goodwill for impairment at December 31, 2014, 2013 and 2012 (the "interim testing

dates").

The estimated fair values of the Newsday business indefinite-lived intangibles, which relate primarily to the trademarks associated

with its mastheads, were based on discounted future cash flows calculated utilizing the relief-from-royalty method. Changes in

such estimates or the application of alternative assumptions could produce significantly different results. The Company's

impairment analysis as of December 31, 2014, 2013 and 2012 resulted in pre-tax impairment charges of $200, $25,100 and $13,000,

respectively, related to the excess of the carrying value over the estimated fair value of the Company's trademarks.

Additionally, in 2014 and 2013, the Company recorded an impairment charge of $5,631 and $12,358, respectively, relating to the

excess of the carrying value over the estimated fair values of Newsday's amortizing subscriber relationships and advertiser

relationships, respectively. The decrease in fair values, which were determined based on discounted cash flows, resulted primarily

from the decline in projected cash flows related to these assets. These pre-tax impairment charges are included in depreciation

and amortization (including impairments) in the Other segment. No goodwill impairments were recorded for the years ended

December 31, 2014, 2013 and 2012.

In addition, the Company recorded impairment charges of $425, $10,997 and $829 in 2014, 2013 and 2012, respectively, included

in depreciation and amortization related primarily to certain other long-lived assets of businesses included in the Other segment.

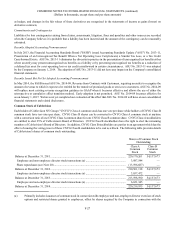

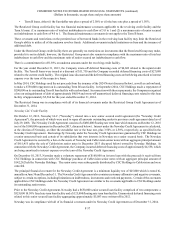

NOTE 5. DISCONTINUED OPERATIONS

In connection with the Bresnan Sale and Clearview Sale discussed above, the operating results of Bresnan Cable (previously

included in the Company's Cable segment) and Clearview Cinemas (previously included in the Company's Other segment) have

been reflected in the Company's consolidated financial statements as discontinued operations for all periods presented.

The proceeds related to the settlement of litigation with DISH Network, LLC (see discussion below) and related costs have been

classified in discontinued operations for the years ended December 31, 2013 and 2012.

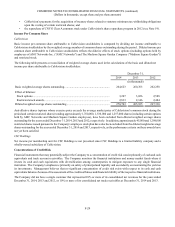

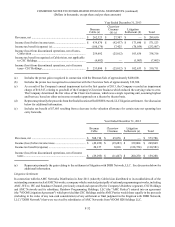

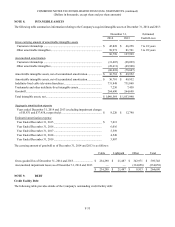

Operating results of discontinued operations for the years ended December 31, 2014, 2013 and 2012 are summarized below:

Year Ended December 31, 2014

Bresnan

Cable (a) Clearview

Cinemas Total

Revenues, net....................................................................................................... $ — $ — $ —

Income (loss) before income taxes...................................................................... $ 5,848 $ (820) $ 5,028

Income tax benefit (expense)............................................................................... (2,542) 336 (2,206)

Income (loss) from discontinued operations, net of income taxes...................... $ 3,306 $ (484) $ 2,822

(a) Represents primarily a gain recognized upon the settlement of a contingency related to Montana property taxes.