Cablevision 2014 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

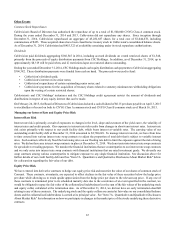

63

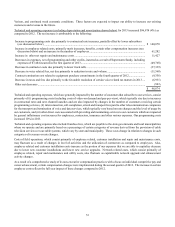

Cablevision Restricted

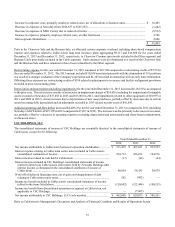

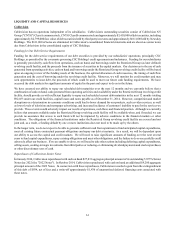

Group Newsday Other

Entities (a) Total

2015 ...................................................................... $ 213,880 $ 361,693 $ 18,100 $ 503,560 $ 1,097,233

2016 ...................................................................... 213,880 378,999 494,104 428,765 1,515,748

2017 ...................................................................... 1,113,880 382,855 98 103,227 1,600,060

2018 ...................................................................... 857,193 1,778,997 — — 2,636,190 (b)

2019 ...................................................................... 78,130 707,183 — — 785,313

Thereafter.............................................................. 1,283,414 3,375,752 — — 4,659,166 (b)

Total...................................................................... $ 3,760,377 $ 6,985,479 $ 512,302 $ 1,035,552 $ 12,293,710

(a) Represents the Company's obligations in connection with monetization contracts it has entered into. The Company has

the option, at maturity, to deliver the shares of common stock underlying the monetization contracts along with proceeds

from the related derivative contracts in full satisfaction of the maturing collateralized indebtedness or obtain the required

cash equivalent of the common stock through new monetization and derivative contracts.

(b) Excludes the $345,238 principal amount of Cablevision 7.75% senior notes due 2018 and $266,217 principal amount of

Cablevision 8.00% senior notes due 2020 held by Newsday Holdings, which are pledged to the lenders under its credit

facility.

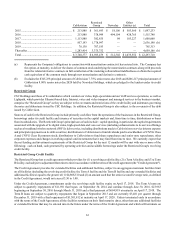

Restricted Group

CSC Holdings and those of its subsidiaries which conduct our video, high-speed data and our VoIP services operations, as well as

Lightpath, which provides Ethernet-based data, Internet, voice and video transport and managed services to the business market,

comprise the "Restricted Group" as they are subject to the covenants and restrictions of the credit facility and indentures governing

the notes and debentures issued by CSC Holdings. In addition, the Restricted Group is also subject to the covenants of the debt

issued by Cablevision.

Sources of cash for the Restricted Group include primarily cash flow from the operations of the businesses in the Restricted Group,

borrowings under its credit facility and issuance of securities in the capital markets and, from time to time, distributions or loans

from its subsidiaries. The Restricted Group's principal uses of cash include: capital spending, in particular, the capital requirements

associated with the upgrade of its digital video, high-speed data and voice services (including enhancements to its service offerings

such as a broadband wireless network (WiFi)); debt service, including distributions made to Cablevision to service interest expense

and principal repayments on its debt securities; distributions to Cablevision to fund dividends paid to stockholders of CNYG Class

A and CNYG Class B common stock; distributions to Cablevision to fund share repurchases and senior note repurchases; other

corporate expenses and changes in working capital; and investments that it may fund from time to time. We currently expect that

the net funding and investment requirements of the Restricted Group for the next 12 months will be met with one or more of the

following: cash on hand, cash generated by operating activities and available borrowings under the Restricted Group's revolving

credit facility.

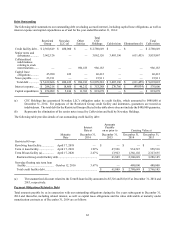

Restricted Group Credit Facility

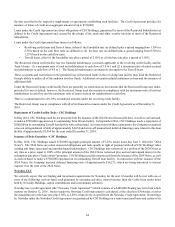

The Restricted Group has a credit agreement which provides for (1) a revolving credit facility, (2) a Term A facility, and (3) a Term

B facility, each subject to adjustment from time to time in accordance with the terms of the credit agreement (the "Credit Agreement").

The Credit Agreement provides for extended facilities and additional facilities, subject to an aggregate maximum facilities limit

on all facilities (including the revolving credit facility, the Term A facility and the Term B facility and any extended facilities and

additional facilities) equal to the greater of (1) $4,808,510 and (2) an amount such that the senior secured leverage ratio, as defined

in the Credit Agreement, would not exceed 3.50 to 1.00.

Under the Credit Agreement, commitments under the revolving credit facility expire on April 17, 2018. The Term A loans are

subject to quarterly repayments of $11,981 that began on September 30, 2014 and continue through June 30, 2016, $23,963

beginning on September 30, 2016 through March 31, 2018 and a final payment of $694,919 at maturity on April 17, 2018. The

Term B loans are subject to quarterly repayments that began in September 2013 and are currently $3,481 per quarter through

December 31, 2019 with a final repayment of $1,301,812 at maturity on April 17, 2020. Unless terminated early in accordance

with the terms of the Credit Agreement, all the facilities terminate on their final maturity dates, other than any additional facilities

or extended facilities that may be entered into in the future under the terms of the Credit Agreement and which will terminate on