Cablevision 2014 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

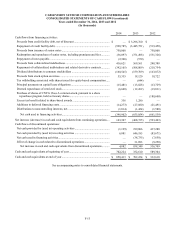

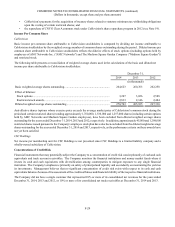

F-22

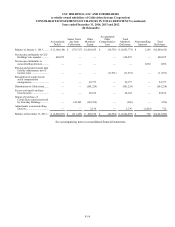

CSC HOLDINGS, LLC AND SUBSIDIARIES

(a wholly-owned subsidiary of Cablevision Systems Corporation)

CONSOLIDATED STATEMENTS OF CASH FLOWS (continued)

Years ended December 31, 2014, 2013 and 2012

(In thousands)

2014 2013 2012

Cash flows from financing activities:

Proceeds from credit facility debt, net of discount .................................................. $ — $ 3,296,760 $ —

Repayment of credit facility debt............................................................................. (990,785)(3,445,751)(519,458)

Proceeds from issuance of senior notes ................................................................... 750,000 — —

Redemption and repurchase of senior notes, including premiums and fees............ —(308,673)(504,501)

Repayment of notes payable.................................................................................... (2,306)(570) —

Proceeds from collateralized indebtedness.............................................................. 416,621 569,561 248,388

Repayment of collateralized indebtedness and related derivative contracts............ (342,105)(508,009)(218,754)

Principal payments on capital lease obligations ...................................................... (15,481)(13,828)(13,729)

Capital contributions from Cablevision................................................................... — — 735,000

Distributions to Cablevision .................................................................................... (396,382)(501,224)(671,809)

Excess tax benefit related to share-based awards .................................................... 4,978 46,164 61,434

Additions to deferred financing costs ...................................................................... (14,273)(27,080)(5,296)

Distributions to noncontrolling interests, net........................................................... (1,014)(1,424)(1,588)

Net cash used in financing activities................................................................... (590,747)(894,074)(890,313)

Net increase (decrease) in cash and cash equivalents from continuing operations.... 157,456 (444,035)(668,376)

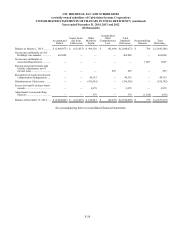

Cash flows of discontinued operations:

Net cash provided by (used in) operating activities................................................. (1,199) 199,006 437,280

Net cash provided by (used in) investing activities ................................................. 6,081 646,185 (83,671)

Net cash used in financing activities....................................................................... —(38,735)(7,650)

Effect of change in cash related to discontinued operations.................................... — 31,893 (9,250)

Net increase in cash and cash equivalents from discontinued operations........... 4,882 838,349 336,709

Cash and cash equivalents at beginning of year......................................................... 651,058 256,744 588,411

Cash and cash equivalents at end of year................................................................... $ 813,396 $ 651,058 $ 256,744

See accompanying notes to consolidated financial statements.