Cablevision 2014 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except share and per share amounts)

F-49

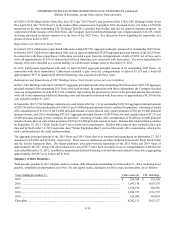

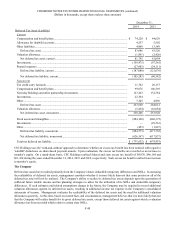

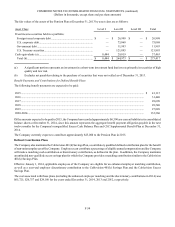

December 31,

2014 2013

Deferred Tax Asset (Liability)

Current

Compensation and benefit plans ...................................................................................................... $ 74,220 $ 44,629

Allowance for doubtful accounts ..................................................................................................... 4,557 5,502

Other liabilities................................................................................................................................. 4,909 13,389

Deferred tax asset ........................................................................................................................ 83,686 63,520

Valuation allowance......................................................................................................................... (1,891)(2,426)

Net deferred tax asset, current..................................................................................................... 81,795 61,094

Investments....................................................................................................................................... (159,475)(97,565)

Prepaid expenses .............................................................................................................................. (27,605)(24,111)

Deferred tax liability, current ...................................................................................................... (187,080)(121,676)

Net deferred tax liability, current................................................................................................. (105,285)(60,582)

Noncurrent

Tax credit carry forwards................................................................................................................. 11,702 20,137

Compensation and benefit plans ...................................................................................................... 99,076 106,595

Newsday Holdings and other partnership investments .................................................................... 123,243 132,384

Investments....................................................................................................................................... 22,294 —

Other................................................................................................................................................. 7,345 4,896

Deferred tax asset ........................................................................................................................ 263,660 264,012

Valuation allowance......................................................................................................................... (5,454)(10,084)

Net deferred tax asset, noncurrent............................................................................................... 258,206 253,928

Fixed assets and intangibles............................................................................................................. (884,120)(840,375)

Investments....................................................................................................................................... — (29,563)

Other................................................................................................................................................. (453)(1,827)

Deferred tax liability, noncurrent ................................................................................................ (884,573)(871,765)

Net deferred tax liability, noncurrent........................................................................................... (626,367)(617,837)

Total net deferred tax liability.......................................................................................................... $ (731,652) $ (678,419)

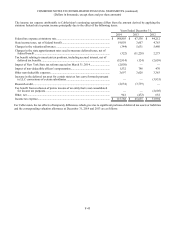

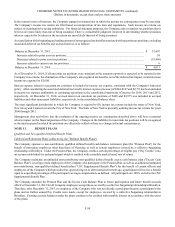

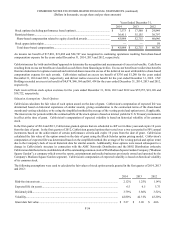

CSC Holdings uses the 'with-and-without' approach to determine whether an excess tax benefit has been realized with regard to

'windfall' deductions on share-based payment awards. Upon realization, the excess tax benefits are recorded as an increase to

member's equity. On a stand-alone basis, CSC Holdings realized federal and state excess tax benefit of $4,978, $46,164 and

$61,434 during the years ended December 31, 2014, 2013 and 2012, respectively. Such excess tax benefit resulted in an increase

to member's equity.

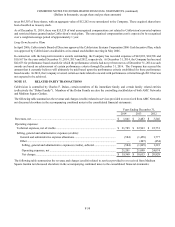

The Company

Deferred tax assets have resulted primarily from the Company's future deductible temporary differences and NOLs. In assessing

the realizability of deferred tax assets, management considers whether it is more likely than not that some portion or all of the

deferred tax asset will not be realized. The Company's ability to realize its deferred tax assets depends upon the generation of

sufficient future taxable income and tax planning strategies to allow for the utilization of its NOLs and deductible temporary

differences. If such estimates and related assumptions change in the future, the Company may be required to record additional

valuation allowances against its deferred tax assets, resulting in additional income tax expense in the Company's consolidated

statements of income. Management evaluates the realizability of the deferred tax assets and the need for additional valuation

allowances quarterly. At this time, based on current facts and circumstances, management believes that it is more likely than not

that the Company will realize benefit for its gross deferred tax assets, except those deferred tax assets against which a valuation

allowance has been recorded which relate to certain state NOLs.