Cablevision 2014 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

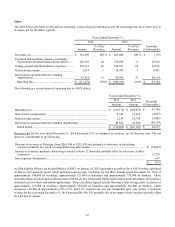

outstanding Term B loan facility in May 2014 and the $200,000 repayment in September 2014. In addition, the 2014 amount

includes the write-off of unamortized deferred financing costs of $1,436 and a net gain of $934, net of fees, recognized in connection

with the repurchase of Cablevision's outstanding 5.875% senior notes due September 2022.

The 2013 amount represents payments in excess of the aggregate principal amount to repurchase CSC Holdings senior notes due

April 2014 and June 2015 and related fees and the write-off of unamortized deferred financing costs and discounts related to such

repurchases, net of a gain recognized in connection with the repurchase of Cablevision's senior notes due September 2022.

Additionally, the 2013 amount includes the write-off of deferred financing costs associated with the refinancing of the Restricted

Group credit facility.

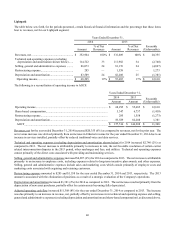

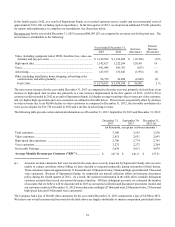

Income tax expense of $115,768 for the year ended December 31, 2014, reflected an effective tax rate of 27%. In January 2014,

the Internal Revenue Service informed the Company that the consolidated federal income tax returns for 2009 and 2010 were no

longer under examination. Accordingly, in the first quarter of 2014, the Company recorded a tax benefit of $53,132 associated

with the reversal of a noncurrent liability relating to an uncertain tax position. New York State corporate tax reform legislation

enacted on March 31, 2014 resulted in tax benefit of $2,050 primarily due to a reduction in the applicable tax rate used to measure

deferred taxes. In 2014, the Company recorded tax benefit of $2,634 related to research credits. Absent these items, the effective

tax rate for the year ended December 31, 2014 would have been 41%.

The Company recorded income tax expense of $65,635 for the year ended December 31, 2013, reflecting an effective tax rate of

34%. An increase in the valuation allowance relating to certain state net operating loss carry forwards resulted in tax expense of

$5,631. In 2013, the Company recorded tax benefits of (i) $3,739 related to research credits, (ii) $11,228 resulting from a change

in the state apportionment rates used to measure deferred taxes, and (iii) $3,851 resulting from a lower tax rate used to determine

deferred tax on unrealized investment gains. Absent these items, the effective tax rate for the year ended December 31, 2013

would have been 41%.

For the year ended December 31, 2014, the Company has fully offset federal taxable income with a net operating loss carry forward

("NOL"). However, the Company is subject to the federal alternative minimum tax and certain state and local income taxes that

are payable quarterly. At December 31, 2014, the Company had consolidated federal NOLs of $619,955. Subsequent to the

utilization of the Company's NOLs and tax credit carry forwards, payments for income taxes are expected to increase significantly.

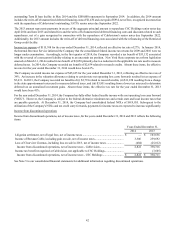

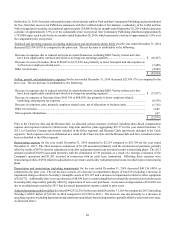

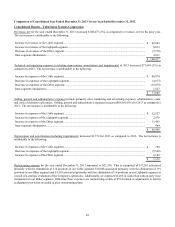

Income from discontinued operations

Income from discontinued operations, net of income taxes, for the years ended December 31, 2014 and 2013 reflects the following

items:

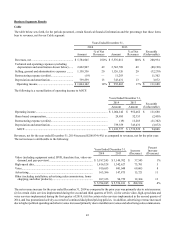

Years Ended December 31,

2014 2013

Litigation settlement, net of legal fees, net of income taxes ......................................................... $ — $ 103,636

Income of Bresnan Cable, including gain on sale, net of income taxes........................................ 3,306 259,692

Loss of Clearview Cinemas, including loss on sale in 2013, net of income taxes........................ (484)(25,012)

Income from discontinued operations, net of income taxes - Cablevision ................................. 2,822 338,316

Income tax benefit recognized at Cablevision, not applicable to CSC Holdings.......................... — (7,605)

Income from discontinued operations, net of income taxes - CSC Holdings............................. $ 2,822 $ 330,711

See Note 5 to our consolidated financial statements for additional information regarding discontinued operations.