Cablevision 2014 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

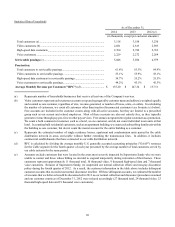

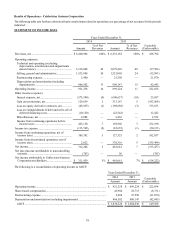

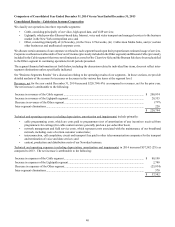

Results of Operations - Cablevision Systems Corporation

The following table sets forth on a historical basis certain items related to operations as a percentage of net revenues for the periods

indicated:

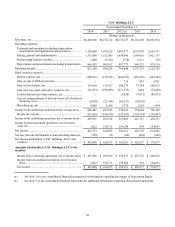

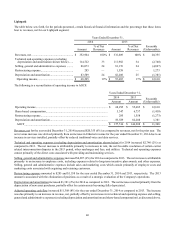

STATEMENT OF INCOME DATA

Years Ended December 31,

2014 2013

Amount % of Net

Revenues Amount % of Net

Revenues Favorable

(Unfavorable)

Revenues, net......................................................... $ 6,460,946 100% $ 6,232,152 100% $ 228,794

Operating expenses:

Technical and operating (excluding

depreciation, amortization and impairments

shown below)................................................... 3,136,808 49 3,079,226 49 (57,582)

Selling, general and administrative..................... 1,533,898 24 1,521,005 24 (12,893)

Restructuring expense......................................... 2,480 — 23,550 — 21,070

Depreciation and amortization (including

impairments).................................................... 866,502 13 909,147 15 42,645

Operating income .................................................. 921,258 14 699,224 11 222,034

Other income (expense):

Interest expense, net............................................ (575,580)(9)(600,637)(10) 25,057

Gain on investments, net..................................... 129,659 2 313,167 5 (183,508)

Loss on equity derivative contracts, net.............. (45,055)(1)(198,688)(3) 153,633

Loss on extinguishment of debt and write-off of

deferred financing costs................................... (10,120) — (22,542) — 12,422

Miscellaneous, net............................................... 4,988 — 2,436 — 2,552

Income from continuing operations before

income taxes.................................................... 425,150 7 192,960 3 232,190

Income tax expense ............................................... (115,768)(2)(65,635)(1)(50,133)

Income from continuing operations, net of

income taxes....................................................... 309,382 5 127,325 2 182,057

Income from discontinued operations, net of

income taxes....................................................... 2,822 — 338,316 5 (335,494)

Net income............................................................. 312,204 5 465,641 7 (153,437)

Net loss (income) attributable to noncontrolling

interests .............................................................. (765) — 20 — (785)

Net income attributable to Cablevision Systems

Corporation stockholders................................... $ 311,439 5% $ 465,661 7% $ (154,222)

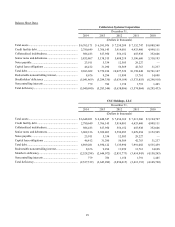

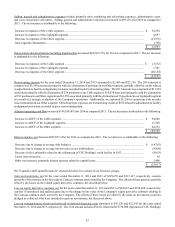

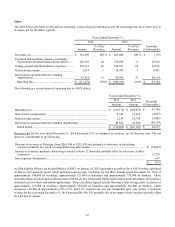

The following is a reconciliation of operating income to AOCF:

Years Ended December 31,

2014 2013 Favorable

(Unfavorable)

Amount Amount

Operating income .................................................................................................. $ 921,258 $ 699,224 $ 222,034

Share-based compensation .................................................................................... 43,984 52,715 (8,731)

Restructuring expense ........................................................................................... 2,480 23,550 (21,070)

Depreciation and amortization (including impairments)....................................... 866,502 909,147 (42,645)

AOCF.................................................................................................................. $ 1,834,224 $ 1,684,636 $ 149,588