Cablevision 2014 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

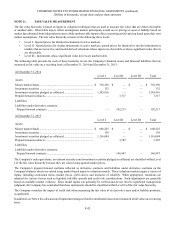

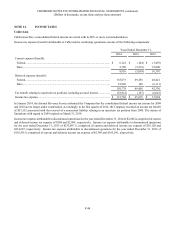

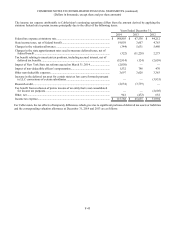

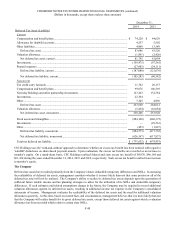

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except share and per share amounts)

F-50

In the normal course of business, the Company engages in transactions in which the income tax consequences may be uncertain.

The Company's income tax returns are filed based on interpretation of tax laws and regulations. Such income tax returns are

subject to examination by taxing authorities. For financial statement purposes, the Company only recognizes tax positions that it

believes are more likely than not of being sustained. There is considerable judgment involved in determining whether positions

taken or expected to be taken on the tax return are more likely than not of being sustained.

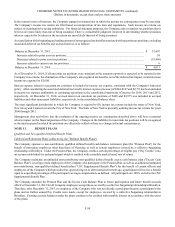

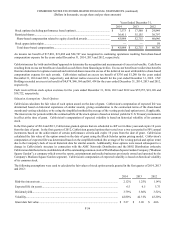

A reconciliation of the beginning and ending amount of unrecognized tax benefits associated with uncertain tax positions, excluding

associated deferred tax benefits and accrued interest, is as follows:

Balance at December 31, 2013................................................................................................................................... $ 57,407

Increases related to prior year tax positions............................................................................................................. 58

Decreases related to prior year tax positions ........................................................................................................... (53,460)

Increases related to current year tax positions......................................................................................................... 6

Balance at December 31, 2014................................................................................................................................... $ 4,011

As of December 31, 2014, if all uncertain tax positions were sustained at the amounts reported or expected to be reported in the

Company's tax returns, the elimination of the Company's unrecognized tax benefits, net of the deferred tax impact, would decrease

income tax expense by $2,608.

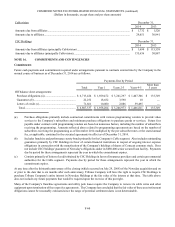

Interest expense related to uncertain tax positions is included in income tax expense, consistent with the Company's historical

policy. After considering the associated deferred tax benefit, interest expense (income) of $284, $107 and $(377) has been included

in income tax expense attributable to continuing operations in the consolidated statements of income for 2014, 2013 and 2012,

respectively. At December 31, 2014, accrued interest on uncertain tax positions of $268 and $2,975 was included in accrued

liabilities and other noncurrent liabilities, respectively, in the consolidated balance sheet.

The most significant jurisdictions in which the Company is required to file income tax returns include the states of New York,

New Jersey and Connecticut and the City of New York. The State of New York is presently auditing income tax returns for years

2006 through 2011.

Management does not believe that the resolution of the ongoing income tax examination described above will have a material

adverse impact on the financial position of the Company. Changes in the liabilities for uncertain tax positions will be recognized

in the interim period in which the positions are effectively settled or there is a change in factual circumstances.

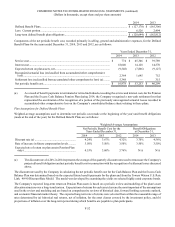

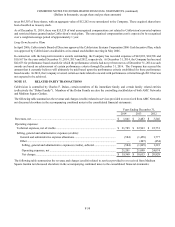

NOTE 13. BENEFIT PLANS

Qualified and Non-qualified Defined Benefit Plans

Cablevision Retirement Plans (collectively, the "Defined Benefit Plans")

The Company sponsors a non-contributory qualified defined benefit cash balance retirement plan (the "Pension Plan") for the

benefit of non-union employees other than those of Newsday, as well as certain employees covered by a collective bargaining

relationship in Brooklyn. Under the Pension Plan, the Company credits a certain percentage of eligible pay (“Pay Credits”) into

an account established for each participant which is credited with a monthly market based rate of return.

The Company maintains an unfunded non-contributory non-qualified defined benefit excess cash balance plan ("Excess Cash

Balance Plan") covering certain employees of the Company who participate in the Pension Plan, as well as an additional unfunded

non-contributory, non-qualified defined benefit plan ("CSC Supplemental Benefit Plan") for the benefit of certain officers and

employees of the Company which provides that, upon retiring on or after normal retirement age, a participant will receive a benefit

equal to a specified percentage of the participant's average compensation, as defined. All participants are 100% vested in the CSC

Supplemental Benefit Plan.

The Company amended the Pension Plan and the Excess Cash Balance Plan to freeze participation and future benefit accruals

effective December 31, 2013 for all Company employees except those covered by a collective bargaining relationship in Brooklyn.

Therefore, after December 31, 2013, no employee of the Company who was not already a participant became a participant in the

plans and no further annual Pay Credits were made, except for employees covered by a collective bargaining relationship in

Brooklyn. Existing account balances under the plans continue to be credited with monthly interest in accordance with the terms

of the plans.