Cablevision 2014 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

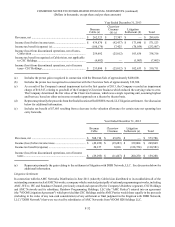

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except share and per share amounts)

F-36

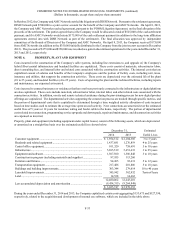

Interest

Rate at

Amounts

Payable

on or prior to Carrying Value at

Maturity

Date December 31,

2014 December 31,

2015 December 31,

2014 December 31,

2013

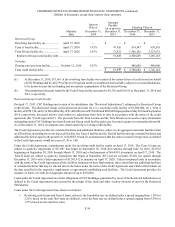

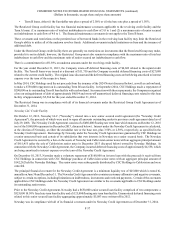

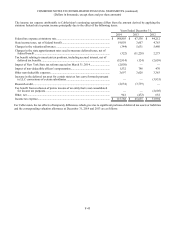

Restricted Group:

Revolving loan facility (a)................... April 17, 2018 — $ — $ — $ —

Term A loan facility............................. April 17, 2018 1.92% 47,926 934,547 958,510

Term B loan facility (b)....................... April 17, 2020 2.67% 13,923 1,366,102 2,327,635

Restricted Group credit facility debt............................................................. 61,849 2,300,649 3,286,145

Newsday:

Floating rate term loan facility ............ October 12, 2016 3.67% — 480,000 480,000

Total credit facility debt................................................................................... $ 61,849 $ 2,780,649 $ 3,766,145

(a) At December 31, 2014, $71,661 of the revolving loan facility was restricted for certain letters of credit issued on behalf

of CSC Holdings and $1,428,339 of the revolving loan facility was undrawn and available, subject to covenant limitations,

to be drawn to meet the net funding and investment requirements of the Restricted Group.

(b) The unamortized discount related to the Term B loan facility amounted to $5,326 and $10,615 at December 31, 2014 and

2013, respectively.

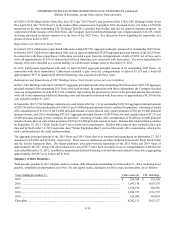

Restricted Group Credit Facility

On April 17, 2013, CSC Holdings and certain of its subsidiaries (the "Restricted Subsidiaries") refinanced its Restricted Group

credit facility. The Restricted Group credit agreement provides for (1) a revolving credit facility of $1,500,000, (2) a Term A

facility of $958,510, and (3) a Term B facility of $1,400,000 (net of $750,000 and $200,000 repayments in May 2014 and September

2014, respectively, discussed below), each subject to adjustment from time to time in accordance with the terms of the credit

agreement (the "Credit Agreement"). The proceeds from the Term A loans and the Term B loans were used to repay all amounts

outstanding under CSC Holdings' previous Restricted Group credit facility and to pay fees and expenses in connection therewith.

As of December 31, 2014, no amounts were drawn under the revolving credit facility.

The Credit Agreement provides for extended facilities and additional facilities, subject to an aggregate maximum facilities limit

on all facilities (including the revolving credit facility, the Term A facility and the Term B facility and any extended facilities and

additional facilities) equal to the greater of (1) $4,808,510 and (2) an amount such that the senior secured leverage ratio, as defined

in the Credit Agreement, would not exceed 3.50 to 1.00.

Under the Credit Agreement, commitments under the revolving credit facility expire on April 17, 2018. The Term A loans are

subject to quarterly repayments of $11,981 that began on September 30, 2014 and continue through June 30, 2016, $23,963

beginning on September 30, 2016 through March 31, 2018 and a final payment of $694,919 at maturity on April 17, 2018. The

Term B loans are subject to quarterly repayments that began in September 2013 and are currently $3,481 per quarter through

December 31, 2019 with a final repayment of $1,301,812 at maturity on April 17, 2020. Unless terminated early in accordance

with the terms of the Credit Agreement, all the facilities terminate on their final maturity dates, other than any additional facilities

or extended facilities that may be entered into in the future under the terms of the Credit Agreement and which will terminate on

the date specified in the respective supplements or agreements establishing such facilities. The Credit Agreement provides for

issuance of letters of credit in an aggregate amount of up to $150,000.

Loans under the Credit Agreement are direct obligations of CSC Holdings, guaranteed by most of the Restricted Subsidiaries (as

defined in the Credit Agreement) and secured by the pledge of the stock and other security interests of most of the Restricted

Subsidiaries.

Loans under the Credit Agreement bear interest as follows:

• Revolving credit loans and Term A loans, either (i) the Eurodollar rate (as defined) plus a spread ranging from 1.50% to

2.25% based on the cash flow ratio (as defined), or (ii) the base rate (as defined) plus a spread ranging from 0.50% to

1.25% based on the cash flow ratio;