Burger King 2010 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2010 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

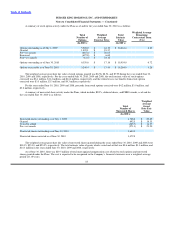

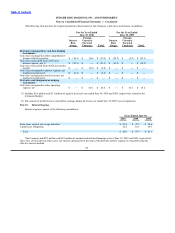

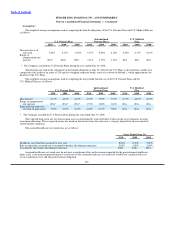

The following table presents the required quantitative disclosures for the Company’s derivative instruments (in millions):

For the Year Ended For the Year Ended

June 30, 2010 June 30, 2009

Foreign Foreign

Interest Currency Interest Currency

Rate Forward Rate Forward

Swaps Contracts Total Swaps Contracts Total

Derivatives designated as cash flow hedging

instruments:

Gain (loss) recognized in other comprehensive

income (effective portion) $ (16.4) $ (0.6) $ (17.0) $ (39.2) $ (0.1) $ (39.3)

Gain (loss) reclassified from AOCI into

interest expense, net(1) $ (21.1) $ — $ (21.1) $ (10.5) $ — $ (10.5)

Gain (loss) reclassified from AOCI into royalty

income $ — $ (0.8) $ (0.8) $ — $ — $ —

Gain (loss) recognized in interest expense, net

(ineffective portion)(2) $ (0.2) $ — $ (0.2) $ — $ — $ —

Gain (loss) recognized in royalty income, net

(ineffective portion)(2) $ — $ — $ — $ — $ — $ —

Derivatives not designated as hedging

instruments:

Gain (loss) recognized in other operating

expense, net $ — $ 44.6 $ 44.6 $ — $ 43.2 $ 43.2

(1) Includes $1.6 million and $1.3 million of gain for the fiscal year ended June 30, 2010 and 2009, respectively, related to the

terminated hedges.

(2) The amount of ineffectiveness recorded in earnings during the fiscal year ended June 30 2009 was not significant.

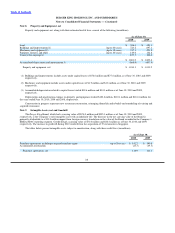

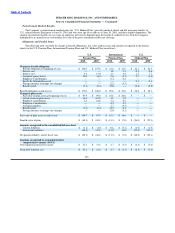

Note 15. Interest Expense

Interest expense consists of the following (in millions):

Years Ended June 30,

2010 2009 2008

Term loans, interest rate swaps and other $ 39.4 $ 47.2 $ 56.4

Capital lease obligations 10.2 10.1 10.7

Total $ 49.6 $ 57.3 $ 67.1

The Company had $2.9 million and $4.9 million of unamortized deferred financing costs at June 30, 2010 and 2009, respectively.

These fees are classified in other assets, net and are amortized over the term of the debt into interest expense on term debt using the

effective interest method.

95