Burger King 2010 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2010 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

deferred income tax liability on these unremitted earnings is not practicable. Such liability, if any, depends on circumstances existing if

and when remittance occurs.

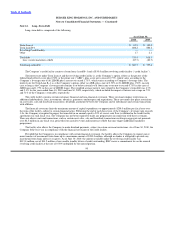

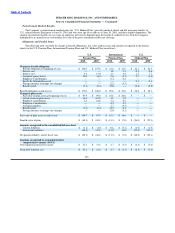

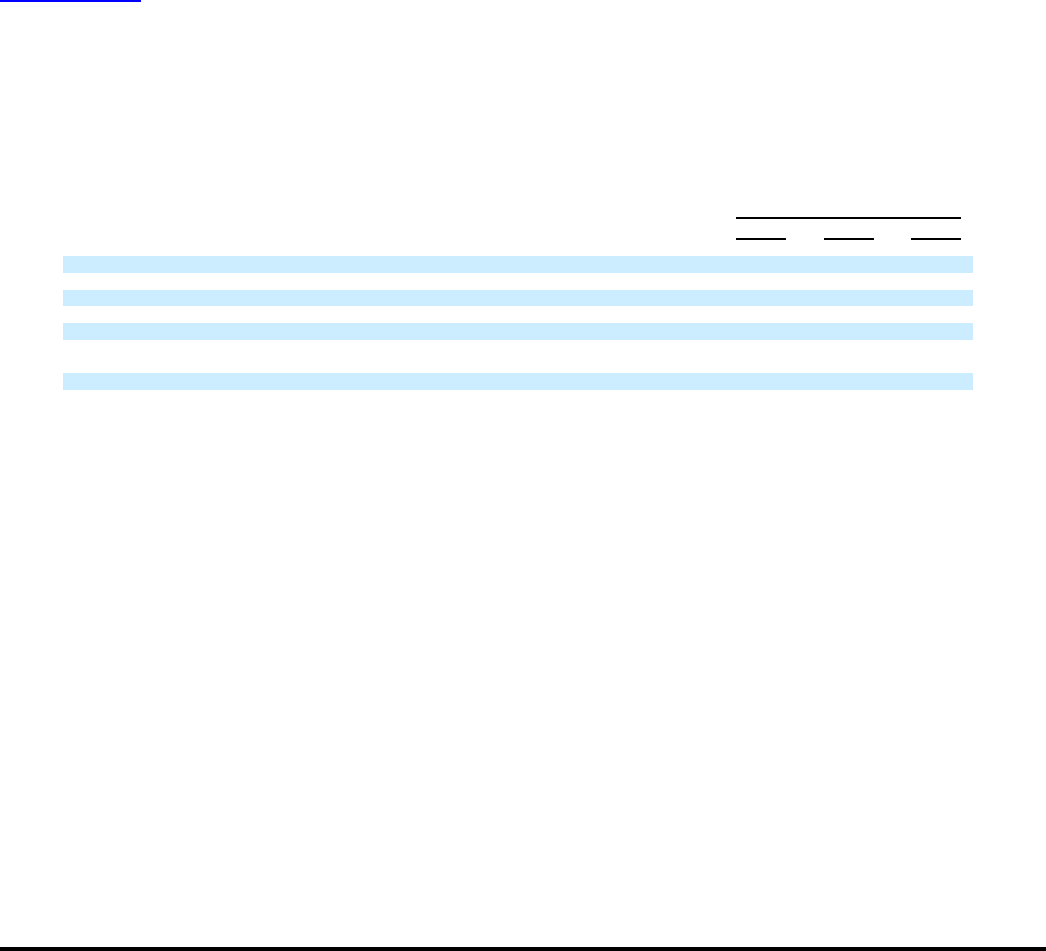

The Company had $14.2 million and $15.5 million of unrecognized tax benefits at June 30, 2010 and 2009, respectively, which if

recognized, would affect the effective income tax rate. A reconciliation of the beginning and ending amounts of unrecognized tax

benefits is as follows:

As of June 30,

2010 2009 2008

Beginning balance $ 15.5 18.3 18.9

Additions on tax position related to the current year 1.2 4.5 3.7

Additions for tax positions of prior years 2.7 1.9 0.6

Reductions for tax positions of prior years (2.0) (7.7) (3.9)

Reductions for settlements (2.0) (0.2) (0.1)

Reductions due to statute expiration (1.2) (1.3) (0.9)

Ending Balance $ 14.2 $ 15.5 $ 18.3

During the twelve months beginning July 1, 2010, it is reasonably possible the Company will reduce unrecognized tax benefits by

a range of approximately $2.0 million to $3.0 million, primarily as a result of the expiration of certain statutes of limitations and the

completion of certain tax audits.

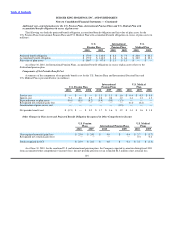

The Company recognizes interest and penalties related to unrecognized tax benefits in income tax expense. The total amount of

accrued interest and penalties at June 30, 2010 and 2009 was $2.9 million and $3.7 million, respectively. Potential interest and penalties

associated with uncertain tax positions recognized during the years ended June 30, 2010 and 2009 were $0.6 million, each year, and

$1.5 million for the year ended June 30, 2008. To the extent interest and penalties are not assessed with respect to uncertain tax

positions, amounts accrued will be reduced and reflected as a reduction of the overall income tax provision.

The Company files income tax returns, including returns for its subsidiaries, with federal, state, local and foreign jurisdictions.

Generally the Company is subject to routine examination by taxing authorities in these jurisdictions, including significant international

tax jurisdictions, such as the United Kingdom, Germany, Spain, Switzerland, Singapore and Mexico. None of the foreign jurisdictions

should be individually material. The Company is currently under audit by the U.S. Internal Revenue Service for the years ended

June 30, 2008 and June 30, 2007. The Company also has various state and foreign income tax returns in the process of examination.

From time to time, these audits result in proposed assessments where the ultimate resolution may result in the Company owing

additional taxes. The Company believes that its tax positions comply with applicable tax law and that it has adequately provided for

these matters.

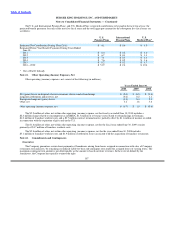

Note 17. Related Party Transactions

The Company paid $1.1 million in registration expenses relating to the secondary offerings during the year ended June 30, 2008.

This amount included registration and filing fees, printing fees, external accounting fees, all reasonable fees and disbursements of one

law firm selected by the Sponsors and all expenses related to the road show for the secondary offerings.

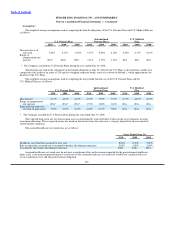

Note 18. Leases

As of June 30, 2010, the Company leased or subleased 1,145 restaurant properties to franchisees and non−restaurant properties to

third parties under capital and operating leases. The building and leasehold improvements of the leases with franchisees are usually

accounted for as direct financing leases and recorded as a net investment in property leased to franchisees, while the land is recorded as

operating leases. Most leases to franchisees provide for

99