Burger King 2010 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2010 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

and declines in consumer spending have increased and may continue to affect the uncertainty inherent in such estimates and

assumptions. As future events and their effects cannot be determined with precision, actual results could differ significantly from these

estimates.

Foreign Currency Translation

The foreign currency of each foreign subsidiary is generally the local currency. Foreign currency balance sheets are translated

using the end of period exchange rates, and statements of income are translated at the average exchange rates for each period. The

translation adjustments resulting from the translation of foreign currency financial statements are recorded in accumulated other

comprehensive income (loss) within stockholders’ equity.

Foreign Currency Transaction Gain or Losses

Foreign currency transaction gains or losses resulting from the re−measurement of foreign−denominated assets and liabilities of

the Company or its subsidiaries are reflected in earnings in the period when the exchange rates change and are included within other

operating (income) expenses, net in the consolidated statements of income.

Cash and Cash Equivalents

Cash and cash equivalents include short−term, highly liquid investments with original maturities of three months or less and credit

card receivables.

Allowance for Doubtful Accounts

The Company evaluates the collectibility of its trade accounts receivable from franchisees based on a combination of factors,

including the length of time the receivables are past due and the probability of collection from litigation or default proceedings, where

applicable. The Company records a specific allowance for doubtful accounts in an amount required to adjust the carrying values of such

balances to the amount that the Company estimates to be net realizable value. The Company writes off a specific account when (a) the

Company enters into an agreement with a franchisee that releases the franchisee from outstanding obligations, (b) franchise agreements

are terminated and the projected costs of collections exceed the benefits expected to be received from pursuing the balance owed

through legal action, or (c) franchisees do not have the financial wherewithal or unprotected assets from which collection is reasonably

assured.

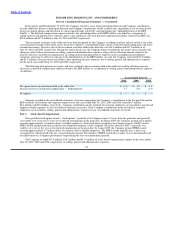

Notes receivable represent loans made to franchisees arising from re−franchisings of Company restaurants, sales of property, and

in certain cases when past due trade receivables from franchisees are restructured into an interest−bearing note. Trade receivables which

are restructured to interest−bearing notes are generally already fully reserved, and as a result, are transferred to notes receivable at a net

carrying value of zero. Notes receivable with a carrying value greater than zero are written down to net realizable value when it is

probable or likely that the Company is unable to collect all amounts due under the contractual terms of the loan agreement.

Inventories

Inventories are stated at the lower of cost (first−in, first−out) or net realizable value, and consist primarily of restaurant food items

and paper supplies. Inventories are included in prepaids and other current assets in the accompanying consolidated balance sheets.

Property and Equipment, net

Property and equipment, net, owned by the Company are recorded at historical cost less accumulated depreciation and

amortization. Depreciation and amortization are computed using the straight−line method based on the estimated useful lives of the

assets. Leasehold improvements to properties where the Company is the lessee are amortized over the lesser of the remaining term of

the lease or the estimated useful life of the improvement. When

77