Burger King 2010 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2010 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

reduced payments for services performed by third parties in the prior year as noted above, decreased repairs and maintenance costs and

the closure of under−performing restaurants and refranchising of Company restaurants in the U.K. (including benefits from the release

of unfavorable lease obligations), offset by increased rents.

In Latin America, occupancy and other operating costs decreased by $0.2 million, or 1%, to $17.8 million for the fiscal year ended

June 30, 2009, primarily as a result of a $2.8 million favorable impact from the movement in currency exchange rates, partially offset

by the net addition of eight Company restaurants during fiscal 2009, increased rents and utility costs and the write−off of unfavorable

leases in the prior year. As a percentage of Company restaurant revenues, occupancy and other operating costs increased by 3.6% to

29.7% as a result of increased utility costs, the write−off of unfavorable leases as noted above, and negative Company comparable sales

growth of 3.2% (in constant currencies).

Selling, General and Administrative Expenses

Selling expenses increased by $1.8 million, or 2%, to $93.3 million for the fiscal year ended June 30, 2009, compared to the prior

fiscal year. The increase, which was primarily driven by an increase in sales and promotional expenses of $8.2 million as a result of

increased sales at our Company restaurants, was partially offset by a $4.0 million favorable impact from the movement of currency

exchange rates and $2.5 million due to lower local marketing expenditures primarily in EMEA.

General and administrative expenses decreased by $8.5 million, or 2%, to $401.0 million for the fiscal year ended June 30, 2009,

compared to the prior fiscal year. The decrease was primarily a result of a $14.9 million favorable impact from the movement of

currency exchange rates, a $1.8 million decrease in travel and meeting expenses and $2.5 million of other miscellaneous benefits. These

factors were partially offset by an increase in stock compensation of $5.0 million, an incremental increase of $3.1 million in

amortization of intangible assets associated with the acquisition of restaurants, and a decrease in the amount of bad debt recoveries, net

of $2.6 million.

Property Expenses

Total property expenses decreased by $4.0 million, or 6.4%, to $58.1 million for the fiscal year ended June 30, 2009, compared to

the same period in the prior fiscal year, primarily as a result of a $5.2 million favorable impact from the movement of currency

exchange rates and the net effect of changes to our property portfolio, which includes the impact of the closure or acquisition of

restaurants leased to franchisees, partially offset by an increase in percentage rent expense generated by worldwide comparable

franchise sales growth of 1.4% (in constant currencies).

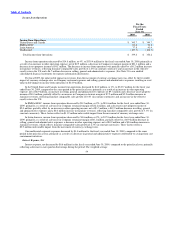

Other Operating (Income) Expense, Net

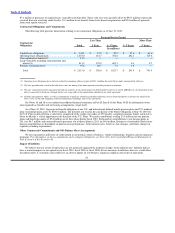

Twelve Months Ended

June 30,

2009 2008

Net (gains) losses on disposal of assets restaurant closures and refranchisings $ (8.5) $ (9.8)

Litigation settlements and reserves, net 0.2 1.1

Foreign exchange net (gains) losses 8.4 2.3

Other, net 1.8 5.8

Other operating (income) expense, net $ 1.9 $ (0.6)

The $1.8 million of other, net within other operating (income) expense, net for the fiscal year ended June 30, 2009 consists

primarily of $1.7 million of franchise workout costs.

The $5.8 million of other, net within other operating (income) expenses, net for the year ended June 30, 2008 includes

$3.1 million of franchise workout costs and $1.9 million of settlement losses associated with the acquisition of franchise restaurants.

58