Burger King 2010 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2010 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

When the Company disposes of a restaurant within six months of acquisition, the goodwill recorded in connection with the

acquisition is written off. Goodwill is written off based on the relative fair value of the business sold to the reporting unit when

disposals occur more than six months after acquisition.

Long−Lived Assets

Long−lived assets, such as property and equipment and acquired intangibles subject to amortization, are tested for impairment

whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. The Company

reviews long−lived assets for indications of impairment on a quarterly basis. Some of the events or changes in circumstances that would

trigger an impairment review include, but are not limited to, a significant under−performance relative to expected and/or historical

results (two consecutive years of negative comparable sales or operating cash flows), significant negative industry or economic trends;

knowledge of transactions involving the sale of similar property at amounts below the carrying value; or our expectation to dispose of

long−lived assets before the end of their estimated useful lives. The impairment test for long−lived assets requires the Company to

assess the recoverability of long−lived assets by comparing their net carrying value to the sum of undiscounted estimated future cash

flows directly associated with and arising from use and eventual disposition of the assets. If the net carrying value of a group of

long−lived assets exceeds the sum of related undiscounted estimated future cash flows, the Company must record an impairment charge

equal to the excess, if any, of net carrying value over fair value.

Long−lived assets are grouped for recognition and measurement of impairment at the lowest level for which identifiable cash

flows are largely independent of the cash flows of other assets. Certain definite−lived intangible assets, consisting primarily of franchise

agreements recorded in connection with acquisition of BKC by the Sponsors, are grouped for impairment reviews at the country level.

Other long−lived assets and related liabilities are grouped together for impairment testing at the operating market level (based on

geographic areas) in the case of the United States, Canada, the U.K. and Germany. The operating market groupings within the United

States and Canada are predominantly based on major metropolitan areas within the United States and Canada. Similarly, operating

markets within the other foreign countries with large asset concentrations (the U.K. and Germany) are comprised of geographic regions

within those countries (three in the U.K. and two in Germany). These operating market definitions are based upon the following

primary factors:

• management views profitability of the restaurants within the operating markets as a whole, based on cash

flows generated by a portfolio of restaurants, rather than by individual restaurants, and area managers

receive incentives on this basis; and

• the Company does not evaluate individual restaurants to build, acquire or close independent of an analysis

of other restaurants in these operating markets.

In countries in which the Company has a smaller number of restaurants, most operating functions and advertising are performed at

the country level, and shared by all restaurants in the country. As a result, the Company has defined operating markets as the entire

country in the case of The Netherlands, Spain, Italy, Mexico, Singapore, and China.

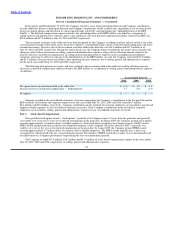

Other Comprehensive Income (Loss)

Other comprehensive income (loss) refers to revenues, expenses, gains, and losses that are included in comprehensive income

(loss), but are excluded from net income as these amounts are recorded directly as an adjustment to stockholders’ equity, net of tax. The

Company’s other comprehensive income (loss) is comprised of unrealized gains and losses on foreign currency translation adjustments,

unrealized gains and losses on hedging activity, net of tax, and minimum pension liability adjustments, net of tax.

79