Burger King 2010 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2010 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

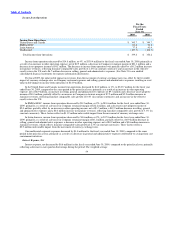

Table of Contents

year. These factors were partially offset by the unfavorable impact from the movement of currency exchange rates in Canada of

$4.0 million. Food, paper and product costs in the U.S. and Canada as a percentage of Company restaurant revenues decreased by 0.5%

to 32.5%, primarily due to lower commodity costs and the benefits realized from strategic pricing initiatives.

In EMEA/APAC, food, paper and product costs increased by $1.2 million, or 1%, to $141.8 million for the fiscal year ended

June 30, 2010, compared to the prior fiscal year, primarily due to the unfavorable impact from the movement of currency exchange

rates of $1.3 million and a net increase in the number of Company restaurants during the fiscal year ended June 30, 2010. Food, paper

and product costs as a percentage of Company restaurant revenues remained relatively unchanged at 29.0%.

In Latin America, food, paper and product costs increased $0.5 million, or 2%, to $23.6 million for the fiscal year ended June 30,

2010, compared to the same period in the prior year, primarily as a result of the increase in Company restaurant revenues discussed

above and the favorable impact from the movement of currency exchange rates of $0.7 million, partially offset by increased commodity

costs. Food, paper and product costs as a percentage of Company restaurant revenues increased by 0.5% to 38.9%, primarily as a result

of the higher commodity costs noted above, partially offset by the benefits realized from strategic pricing initiatives.

Payroll and employee benefits costs

Total payroll and employee benefits costs decreased by $13.5 million, or 2%, to $568.7 million for the fiscal year ended June 30,

2010, compared to the prior fiscal year. The decrease was primarily due to efficiencies gained from improvements in variable labor

controls and scheduling in our U.S. and Canada segment and a net decrease in the number of Company restaurants during the fiscal year

ended June 30, 2010, partially offset by the unfavorable impact from the movement of currency exchange rates of $5.2 million. As a

percentage of Company restaurant revenues, total payroll and employee benefits costs remained relatively unchanged at 30.9% during

the fiscal year ended June 30, 2010. The adverse impact of sales deleverage on our fixed labor costs due to negative Company

comparable sales across all segments was offset by the improvements in variable labor controls and scheduling in our U.S. and Canada

segment as noted above and labor efficiencies in our EMEA/APAC segment.

In the U.S. and Canada, payroll and employee benefits costs decreased by $14.1 million, or 3%, to $400.8 million for the fiscal

year ended June 30, 3010, compared to the prior fiscal year, primarily due to a net decrease in the number of Company restaurants and

efficiencies gained from improvements in variable labor controls in our U.S. Company restaurants. Partially offsetting these factors was

the unfavorable impact from the movement of currency exchange rates of $4.0 million in Canada and minimum wage increases in

certain U.S. markets. As a percentage of Company restaurant revenues, payroll and employee benefits costs remained unchanged at

31.1% due to the improvements in variable labor controls noted above which were offset by the unfavorable impact of sales deleverage

on our fixed costs due to negative Company comparable sales growth in the U.S. and minimum wage increases in certain markets.

In EMEA/APAC, payroll and employee benefits costs increased by $0.6 million, or 0.4%, to $160.5 million for the fiscal year

ended June 30, 2010, compared to the prior fiscal year, primarily due to a $1.5 million unfavorable impact from the movement of

currency exchange rates, primarily in EMEA, and a net increase in the number of Company restaurants during the fiscal year as noted

above. As a percentage of Company restaurant revenues, payroll and employee benefit costs increased by 0.1% to 32.8%, primarily due

to the adverse impact of sales deleverage on our fixed labor costs due to negative comparable sales in Germany, partially offset by

improved labor productivity, primarily in APAC.

There was no significant change in payroll and employee benefits costs in Latin America for the fiscal year ended June 30, 2010,

compared to the prior fiscal year.

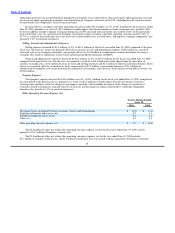

Occupancy and other operating costs

Total occupancy and other operating costs increased by $3.3 million, or 1%, to $461.1 million for the fiscal year ended June 30,

2010, compared to the prior fiscal year, primarily due to a $4.0 million unfavorable impact from the movement of currency exchange

rates, additional depreciation expense resulting from an increase in depreciable

51