Burger King 2010 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2010 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

Note 19. Stockholders’ Equity

Dividends Paid

During each of the years ended June 30, 2010, 2009, and 2008, the Company declared four quarterly cash dividends of $0.0625

per share on its common stock. Total dividends paid by the Company during each of the years ended June 30, 2010, 2009, and 2008

was $34.2 million, $34.1 million, and $34.2 million, respectively.

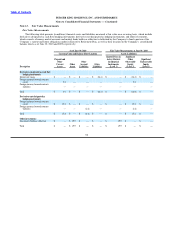

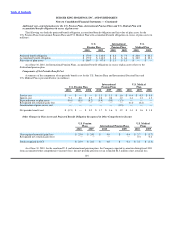

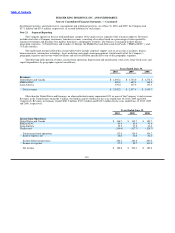

Accumulated Other Comprehensive Income (Loss)

The following table displays the change in the components of accumulated other comprehensive income (loss) (in millions):

Accumulated

Foreign Other

Currency Comprehensive

Derivatives Pensions Translation Income (Loss)

Balances at June 30, 2007 $ 7.6 $ 4.5 $ (4.6) $ 7.5

Foreign currency translation adjustment — — (1.7) (1.7)

Net change in fair value of derivatives, net of tax of

$3.9 million (6.4) — — (6.4)

Amounts reclassified to earnings during the period from

terminated swaps, net of tax $1.1 million (1.3) — — (1.3)

Pension and post−retirement benefit plans, net of tax of

$4.5 million — (6.5) — (6.5)

Balances at June 30, 2008 (0.1) (2.0) (6.3) (8.4)

Foreign currency translation adjustment — — (6.0) (6.0)

Net change in fair value of derivatives, net of tax of

$10.6 million (16.8) — — (16.8)

Amounts reclassified to earnings during the period from

terminated swaps, net of tax $0.4 million (0.9) — — (0.9)

Pension and post−retirement benefit plans, net of tax of

$9.2 million — (13.8) — (13.8)

Balances at June 30, 2009 (17.8) (15.8) (12.3) (45.9)

Foreign currency translation adjustment — — (4.4) (4.4)

Net change in fair value of derivatives, net of tax of

$2.6 million 4.1 — — 4.1

Amounts reclassified to earnings during the period from

terminated swaps, net of tax $0.6 million (1.0) — — (1.0)

Pension and post−retirement benefit plans, net of tax of

$11.3 million — (19.7) — (19.7)

Balances at June 30, 2010 $ (14.7) $ (35.5) $ (16.7) $ (66.9)

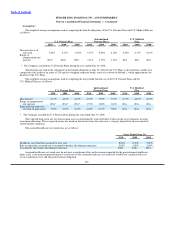

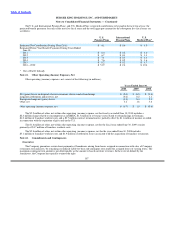

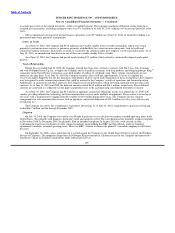

Note 20. Pension and Post Retirement Medical Benefits

Pension Benefits

The Company sponsors noncontributory defined benefit pension plans for its salaried employees in the United States (the

“U.S. Pension Plans”) and certain employees in the United Kingdom, Germany and Switzerland (the “International Pension Plans”).

Effective December 31, 2005, all benefits accrued under the U.S. Pension Plans were frozen at the benefit level attained as of that date.

102