Burger King 2010 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2010 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Chance of Meatballstm, Transformerstm 2, Hoodwinked Tootm, The Spectacular Spidermantm, Polly Pockettm and Pinkalicioustm which

were also leveraged across many international markets.

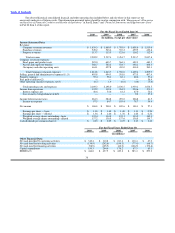

Positive comparable sales growth in EMEA/APAC of 0.8% (in constant currencies) for the fiscal year ended June 30, 2010, was

driven by the strength of Spain, Turkey and our major APAC markets, including Australia, New Zealand and Korea. Comparable sales

growth was positive despite the fact that Germany, one of our major markets in this segment, experienced negative comparable sales

growth due to traffic declines caused by lower discretionary spending, weak consumer confidence and competitive factors. Although

positive for the fiscal year, comparable sales growth in the U.K. was negative during second half of the year due to deteriorating

macroeconomic conditions, adverse weather conditions and the fact that the U.K. market was lapping over strong comparable sales

growth in the prior fiscal year. During the period, we focused in EMEA/APAC on promoting our barbell menu strategy with a

combination of value and premium offerings, such as value−oriented King Dealstm, Stunner Dealstm and the Chili Cheese Burger

limited time offer and higher margin premium products including the Chicken TenderCrisp® sandwich, Chicken TenderGrill®

sandwich, Whopper® sandwich promotions and various limited time offers.

Negative comparable sales growth in Latin America of 1.3% (in constant currencies) for the fiscal year ended June 30, 2010, was

the result of a decline in traffic compared to the prior fiscal year, particularly in Mexico and Central America, driven by continued

adverse socioeconomic conditions. During the fiscal year we continued to leverage our barbell menu strategy with everyday branded

value platforms such as Come Como Reytm (Eat Like a King), BKtm Ofertas (King Deals) and premium promotional products, such as

the Bourbon Whopper® sandwich, in addition to the national launch of the Mega Angus XTtm sandwich in Mexico, the Transformerstm

BBQ Stackticontm and Whopper® Furioso (aka Angry Whopper®) promotion burgers regionally, the Whopper® Jackpot sweepstakes as

well as strong kids’ properties, such as Transformerstm, Pokémontm, G.I. Joetm, Cloudy with a Chance of Meatballstm, SpongeBob

SquarePantstm, Planet 51tm and Iron Mantm 2.

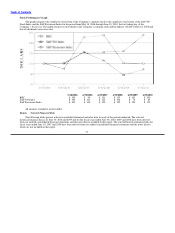

Comparable sales growth in the United States and Canada for the fiscal year ended June 30, 2009, was driven primarily by our

strategic pricing initiatives and barbell menu strategy focusing on premium products and value offerings. However, comparable sales

for the period were negatively impacted by significant traffic declines during the third and fourth quarters, driven by continued adverse

macroeconomic conditions, including higher unemployment, more customers eating at home and heavy discounting by other restaurant

chains. Products and promotions featured during fiscal 2009 include BK Burger Shots® and BK Breakfast Shotstm, Whopper sandwich

limited time offers, such as “Transform your Whopper,” the introduction of the new BK® Kids Meal (including Kraft® Macaroni and

Cheese and BK® Fresh Apple Fries), the Angry Whoppertm sandwich, the Steakhouse Burger, the Spicy Chicken BK Wrapper® and the

Whopper Virgins and Whopper Sacrifice marketing campaigns. SuperFamily promotions, such as Star Trek tm, Transformerstm2,

Pokémontm, Sponge Bob SquarePantstm, The Simpsonstm, iDogtm and a Nintendotm giveaway promotional tie−in with the BK® Crown

Card, also contributed to positive comparable sales.

Comparable sales growth in EMEA/APAC for the fiscal year ended June 30, 2009, reflected positive sales performance in most

major countries in this segment, with the exception of Germany, which experienced negative comparable sales growth during the period

due to significant traffic declines in the third and fourth quarters caused by adverse economic conditions and heavy discounting by our

major competitor in Germany. Positive comparable sales were driven primarily by our strategic pricing initiatives, operational

improvements, value−driven promotions such as the King Deals in Germany, the U.K. and Spain and the Whopper sandwich and

Whopper Jr. sandwich value meal promotions in Australia, as well as high quality premium products such as Whopper sandwich limited

time offers throughout the segment, BK Fusiontm Real Ice Cream and the Long Chickentm sandwich limited time offer in Spain.

SuperFamily promotions, such as The Simpsonstm, iDogtm, Crayolatm and Secret Palazztm, positively impacted comparable sales for the

fiscal year. Comparable sales in EMEA/APAC for fiscal 2009 were negatively impacted by traffic declines during the third and fourth

quarters, particularly in Germany.

Although comparable sales increased in Latin America for the fiscal year ended June 30, 2009, our sales performance was

negatively impacted by significant traffic declines in the third and fourth quarters, particularly in Mexico, due to continued adverse

socioeconomic conditions and the resulting slowdown in tourism, the H1N1 flu pandemic in Mexico and South America, the

devaluation of local currencies and lower influx of remittances from

46