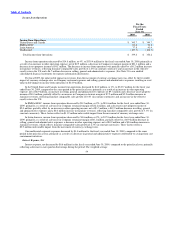

Burger King 2010 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2010 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

assets and accelerated depreciation associated with strategic initiatives, such as our restaurant reimaging program and our new POS

system. These factors were partially offset by a net decrease in the number of Company restaurants during the fiscal year ended June 30,

2010, favorable adjustments to the self−insurance reserve in the U.S., lower utility costs and lower start−up expenses as a result of

fewer Company restaurant openings and acquisitions.

As a percentage of Company restaurant revenues, occupancy and other operating costs increased by 0.8% to 25.1% for the fiscal

year ended June 30, 2010, compared to the prior fiscal year, primarily as a result of the adverse impact of sales deleverage on our fixed

occupancy and other operating costs due to negative Company comparable sales across all segments and the increases in occupancy and

other operating costs discussed above. These factors were partially offset by the benefits realized from favorable adjustments to the

self−insurance reserve in the U.S. as noted above.

In the U.S. and Canada, occupancy and other operating costs decreased by $8.2 million, or 3%, to $298.6 million for the fiscal

year ended June 30, 2010, compared to the prior fiscal year. The decrease was primarily driven by a net reduction in the number of

Company restaurants during the fiscal year, favorable adjustments to the self−insurance reserve in the U.S., lower utility costs and

lower start−up expenses as a result of fewer Company restaurant openings and acquisitions. These factors were partially offset by

additional depreciation expense resulting from an increase in depreciable assets and accelerated depreciation associated with the

strategic initiatives discussed above, and a $3.0 million unfavorable impact from the movement of currency exchange rates. As a

percentage of Company restaurant revenues, occupancy and other operating costs increased by 0.1% to 23.2%, primarily due to the

adverse impact of sales deleverage on our fixed occupancy and other operating costs and increased depreciation expense as noted

above, partially offset by the benefits realized from adjustments to the self−insurance reserve in the U.S.

In EMEA/APAC, occupancy and other operating costs increased by $11.5 million, or 9%, to $144.7 million for the fiscal year

ended June 30, 2010, compared to the prior fiscal year. The increase was primarily due to a net increase in the number of Company

restaurants during the fiscal year, a $1.4 million unfavorable impact from the movement of currency exchange rates, primarily in

EMEA, an increase in start−up expenses related to new restaurant openings and higher repair and maintenance costs, primarily in

Germany in conjunction with our refranchising initiative. As a percentage of Company restaurant revenues, occupancy and other

operating costs increased by 2.3% to 29.6%, primarily due to the adverse impact of sales deleverage on our fixed occupancy and other

operating costs.

There was no significant change in occupancy and other operating costs in Latin America for the fiscal year ended June 30, 2010,

compared to the prior fiscal year.

Selling, general and administrative expenses

Selling expenses decreased by $2.0 million, or 2%, to $91.3 million for the fiscal year ended June 30, 2010, compared to the prior

fiscal year, primarily due to a $3.5 million reduction in contributions to the marketing funds in our Company restaurant markets as a

result of lower Company restaurants revenues. Partially offsetting this decrease was an increase of $1.0 million of higher local

marketing expenditures aimed at driving incremental sales and $0.6 million from the movement of currency exchange rates for the

period.

General and administrative expenses increased by $3.5 million, or 1%, to $404.5 million for the fiscal year ended June 30, 2010,

compared to the prior fiscal year, largely driven by an increase in professional fees of $4.7 million, primarily related to information

technology initiatives, incremental depreciation expense of $2.6 million due to a higher depreciable asset base compared to prior year,

and higher salary and fringe benefit costs of $3.0 million including share−based compensation. These items were partially offset by

savings from reductions in travel and meetings of $4.1 million and office operating expenses of $3.2 million. These fluctuations include

the unfavorable impact form the movement of currency exchange rates of $4.3 million for the fiscal year ended June 30, 2010.

Property Expenses

Total property expenses increased by $1.3 million, or 2%, to $59.4 million for the fiscal year ended June 30, 2010, compared to

the prior fiscal year, primarily attributable to increased rent expense resulting from the net effect

52