Burger King 2010 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2010 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

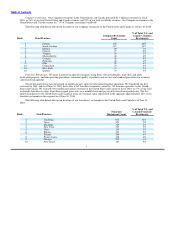

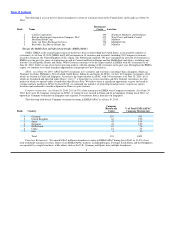

The following is a list of the five largest franchisees in terms of restaurant count in EMEA/APAC as of June 30, 2010:

Rank Name Restaurant Count Location

1 Tab Gida 309 Turkey

2 Hungry Jack’s Pty Ltd. 276 Australia

3 Olayan Food Service Company 127 Saudi Arabia /UAE/Egypt

4 System Restaurant Service Korea Co. Ltd. 107 Korea

5 Al−Homaizi Foodstuff Company 91 United Kingdom/Kuwait

Latin America

As of June 30, 2010, we had 1,138 restaurants in 27 countries and territories in Latin America. There were 97 Company

restaurants in Latin America, all located in Mexico, and 1,041 franchise restaurants in the segment as of June 30, 2010. Mexico is the

largest market in this segment, with a total of 418 restaurants as of June 30, 2010, or 37% of the region.

We believe that there are significant growth opportunities in South America. For example, we entered the Brazil market five years

ago, and, as of June 30, 2010, had 93 restaurants in the country with those open for more than 12 months having average restaurant

sales of $1.8 million on a trailing twelve−month basis. We currently expect to open approximately 500 restaurants in Latin America

over the next five years. For the fiscal year, we opened 72 new restaurants in Latin America.

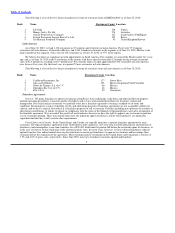

The following is a list of the five largest franchisees in terms of restaurant count in Latin America as of June 30, 2010:

Rank Name Restaurant Count Location

1 Caribbean Restaurants, Inc. 177 Puerto Rico

2 Alsea and Affiliates 191 Mexico/Argentina/Chile/Colombia

3 Geboy de Tijuana, S.A. de C.V. 66 Mexico

4 Operadora Exe S.A. de C.V. 48 Mexico

5 B & A S.A. 42 Guatemala

Franchise Agreements

General. We grant franchises to operate restaurants using Burger King trademarks, trade dress and other intellectual property,

uniform operating procedures, consistent quality of products and services and standard procedures for inventory control and

management. For each franchise restaurant, we generally enter into a franchise agreement covering a standard set of terms and

conditions. Recurring fees consist of monthly royalty and advertising payments. Franchise agreements are not assignable without our

consent, and we have a right of first refusal if a franchisee proposes to sell a restaurant. Defaults (including non−payment of royalties or

advertising contributions, or failure to operate in compliance with the terms of the Manual of Operating Data) can lead to termination of

the franchise agreement. We can control the growth of our franchisees because we have the right to approve any restaurant acquisition

or new restaurant opening. These transactions must meet our minimum approval criteria to ensure that franchisees are adequately

capitalized and that they satisfy certain other requirements.

United States and Canada. In the United States and Canada, we typically enter into a separate franchise agreement for each

restaurant. The typical franchise agreement in the United States and Canada has a 20−year term (for both initial grants and renewals of

franchises) and contemplates a one−time franchise fee of $50,000 which must be paid in full before the restaurant opens for business, or

in the case of renewal, before expiration of the current franchise term. In recent years, however, we have offered franchisees reduced

upfront franchise fees and/or limited−term royalty reductions to encourage franchisees to open new restaurants and/or reimage their

restaurant before the expiration of the agreement. Most existing franchise restaurants in the United States and Canada pay a royalty of

3.5% and 4.0% of gross sales, respectively. Since June 2003, most new franchise restaurants opened and franchise

9