Burger King 2010 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2010 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

$7.4 million of payments on capital leases, term debt and other debt. These cash uses were partially offset by $94.3 million of proceeds

received from our revolving credit facility, $3.3 million in tax benefits from stock−based compensation and $3.0 million of proceeds

from stock option exercises.

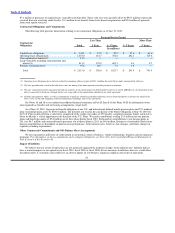

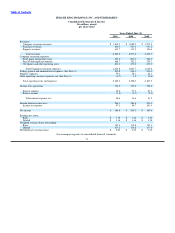

Contractual Obligations and Commitments

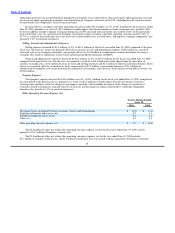

The following table presents information relating to our contractual obligations as of June 30, 2010:

Payment Due by Period

Less Than More Than

Contractual

Obligations Total 1 Year 1−3 Years 3−5 Years 5 Years

(In millions)

Capital lease obligations $ 134.1 $ 15.2 $ 29.7 $ 27.6 $ 61.6

Operating lease obligations(1) 1,455.0 161.7 301.6 262.1 729.6

Unrecognized tax benefits(2) 17.5 — — — —

Long−term debt, including current portion and

interest(3) 811.2 125.0 685.1 0.4 0.7

Purchase commitments(4) 95.8 86.7 7.3 1.8 —

Total $ 2,513.6 $ 388.6 $ 1,023.7 $ 291.9 $ 791.9

(1) Operating lease obligations have not been reduced by minimum sublease rentals of $343.1 million due in the future under noncancelable subleases.

(2) We have provided only a total in the table above since the timing of the unrecognized tax benefit payments is unknown.

(3) We have estimated our interest payments through the maturity of our current long−term debt facilities based on (i) current LIBOR rates, (ii) the portion of our

debt we converted to fixed rates through interest rate swaps and (iii) the amortization schedule in our credit agreement.

(4) Includes open purchase orders, as well as commitments to purchase advertising and other marketing services from third parties in advance on behalf of the

Burger King system and obligations related to information technology and service agreements.

See Notes 16 and 18 to our audited consolidated financial statements in Part II, Item 8 of this Form 10−K for information about

unrecognized tax benefits and our leasing arrangements, respectively.

As of June 30, 2010, the projected benefit obligation of our U.S. and international defined benefit pension plans and U.S. medical

plan exceeded pension assets by $106.6 million. The discount rate used in the calculation of the benefit obligation at June 30, 2010 for

the U.S. Plans is derived from a yield curve comprised of the yields of an index of 250 equally−weighted corporate bonds, rated AA or

better by Moody’s, which approximates the duration of the U.S. Plans. We made contributions totaling $3.5 million into our pension

plans and benefit payments of $5.6 million out of these plans during fiscal 2010. Estimated net contributions to our pension plans in

2011 are $6.7 million and estimated benefit payments out of theses plans in 2011 are $6.6 million. Estimates of reasonably likely future

pension contributions are dependent on pension asset performance, future interest rates, future tax law changes, and future changes in

regulatory funding requirements.

Other Commercial Commitments and Off−Balance Sheet Arrangements

We have guarantees and letters of credit issued in our normal course of business, vendor relationships, litigation and our insurance

programs. For information on these commitments and contingent obligations, see Note 22 to the Consolidated Financial Statements in

Part II, Item 8 of this Form 10−K.

Impact of Inflation

We believe that our results of operations are not materially impacted by moderate changes in the inflation rate. Inflation did not

have a material impact on our operations in fiscal 2010, fiscal 2009 or fiscal 2008. Severe increases in inflation, however, could affect

the global and U.S. economies and could have an adverse impact on our business, financial condition and results of operations.

63