Burger King 2010 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2010 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

National Franchisee Association v. Burger King Corporation, No. 09−CV−23435 (U.S. District Court for the Southern District of

Florida) and Family Dining, Inc. v. Burger King Corporation, No. 10−CV−21964 (U.S. District Court for the Southern District of

Florida). The National Franchisee Association, Inc. and several individual franchisees filed these class action lawsuits on November 10,

2009, and June 15, 2010, respectively, claiming to represent Burger King franchisees. The lawsuits seek a judicial declaration that the

franchise agreements between BKC and its franchisees do not obligate the franchisees to comply with maximum price points set by

BKC for products on the BK® Value Menu sold by the franchisees, specifically the 1/4 lb. Double Cheeseburger and the Buck Double.

The Family Dining case also seeks monetary damages for financial loss incurred by franchisees who were required to sell those

products for no more than $1.00. In May 2010, the court entered an order in the NFA v. BKC case granting in part BKC’s motion to

dismiss. The court held that BKC had the authority under its franchise agreements to set maximum prices but that, for purposes of a

motion to dismiss, the NFA had asserted a “plausible” claim that BKC’s decision may not have been made in good faith. Both cases

have been consolidated in front of the same judge. While the Company believes its decision to put the 1/4 lb. Double Cheeseburger and

the Buck Double on the BK Value Menu was made in good faith, the Company is unable to predict the ultimate outcome of these cases.

From time to time, we are involved in other legal proceedings arising in the ordinary course of business relating to matters

including, but not limited to, disputes with franchisees, suppliers, employees and customers, as well as disputes over our intellectual

property.

Part II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market for Our Common Stock

Our common stock trades on the New York Stock Exchange under the symbol “BKC.” Trading of our common stock commenced

on May 18, 2006, following the completion of our initial public offering. Prior to that date, no public market existed for our common

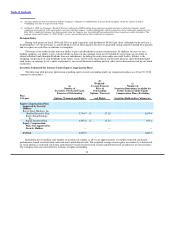

stock. As of August 19, 2010, there were approximately 524 holders of record of our common stock. The following table sets forth the

high and low sales prices of our common stock as reported on the New York Stock Exchange and dividends declared per share of

common stock for each of the quarters in fiscal 2010 and fiscal 2009:

2010 2009

Dollars

per

Share: High Low Dividend High Low Dividend

First Quarter $ 19.50 $ 15.61 $ 0.0625 $ 30.95 $ 22.77 $ 0.0625

Second Quarter $ 19.13 $ 16.63 $ 0.0625 $ 24.93 $ 16.56 $ 0.0625

Third Quarter $ 21.51 $ 17.10 $ 0.0625 $ 24.48 $ 19.21 $ 0.0625

Fourth Quarter $ 22.19 $ 16.80 $ 0.0625 $ 24.10 $ 15.85 $ 0.0625

Issuer Purchases of Equity Securities

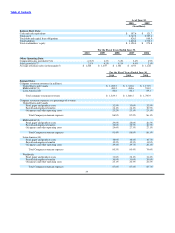

The following table presents information related to the repurchase of our common stock during the three months ended June 30,

2010:

Maximum Number (or

Total Number of Shares Approximate Dollar Value) of

Total Number Purchased as Part of Shares That May Yet be

of Shares Average Price Publicly Announced Purchased Under

Period Purchased(1) Paid per Share Plans or Programs(2) the Plans or Programs(2)

April 1−30, 2010 — — — $ 200,000,000

May 1−31, 2010 15,366 $ 20.07 — $ 200,000,000

June 1−30, 2010 — — — $ 200,000,000

Total 15,366 $ 20.07 — $ 200,000,000

35