Burger King 2010 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2010 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

(1) All shares purchased were in connection with the Company’s obligation to withhold from restricted stock and option awards the amount of federal

withholding taxes due in respect of such awards.

(2) On March 4, 2009, the Company’s Board of Directors authorized a $200.0 million share repurchase program pursuant to which the Company would

repurchase shares directly in the open market consistent with the Company’s insider trading policy and also repurchase shares under plans complying with

Rule 10b5−1 under the Exchange Act during periods when the Company may be prohibited from making direct share repurchases under such policy. The

program expires on December 31, 2010. To date, we have not repurchased any shares under the new program.

Dividend Policy

During each quarter of fiscal 2009 and 2010, we paid a quarterly cash dividend of $0.0625 per share. Although we do not have a

dividend policy, we elected to pay a cash dividend in each of these quarters because we generated strong cash flow during these periods,

and we expect our cash flow to continue to strengthen.

The terms of our credit facility limit our ability to pay cash dividends in certain circumstances. In addition, because we are a

holding company, our ability to pay cash dividends on shares of our common stock may be limited by restrictions on our ability to

obtain sufficient funds through dividends from our subsidiaries, including the restrictions under our credit facility. Subject to the

foregoing, the payment of cash dividends in the future, if any, will be at the discretion of our board of directors and will depend upon

such factors as earnings levels, capital requirements, our overall financial condition and any other factors deemed relevant by our board

of directors.

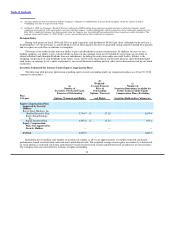

Securities Authorized for Issuance Under Equity Compensation Plans

The following table presents information regarding equity awards outstanding under our compensation plans as of June 30, 2010

(amounts in thousands):

(b)

Weighted− (c)

(a) Average Exercise Number of

Number of Price of Securities Remaining Available for

Securities to be Issued Upon Outstanding Future Issuance under Equity

Exercise of Outstanding Options, Warrants Compensation Plans (Excluding

Plan

Category Options, Warrants and Rights and Rights Securities Reflected in Column (a))

Equity Compensation Plans

Approved by Security

Holders:

Burger King Holdings, Inc.

Omnibus Incentive Plan 3,704.7 $ 17.10 2,670.4

Burger King Holdings,

Inc.

Equity Incentive Plan 4,297.8 $ 17.24 935.1

Equity Compensation

Plans Not Approved by

Security Holders — — —

TOTAL 8,002.5 3,605.5

Included in the 8.0 million total number of securities in column (a) above are approximately 1.6 million restricted stock units,

performance−based restricted stock and stock units and deferred stock. The weighted average exercise price in column (b) is based only

on stock options as restricted stock units, performance−based restricted stock awards and deferred stock awards have no exercise price.

The Company does not currently have warrants or rights outstanding.

36