Burger King 2010 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2010 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

Derivative Financial Instruments

Gains or losses resulting from changes in the fair value of derivatives are recognized in earnings or recorded in other

comprehensive income (loss) and recognized in the statements of income when the hedged item affects earnings, depending on the

purpose of the derivatives and whether they qualify for, and the Company has applied hedge accounting treatment.

When applying hedge accounting, the Company’s policy is to designate, at a derivative’s inception, the specific assets, liabilities

or future commitments being hedged, and to assess the hedge’s effectiveness at inception and on an ongoing basis. The Company may

elect not to designate the derivative as a hedging instrument where the same financial impact is achieved in the financial statements.

The Company does not enter into or hold derivatives for speculative purposes.

Disclosures About Fair Value of Financial Instruments

The Company adopted the required fair value measurements and disclosure provisions of Financial Accounting Standard Board

(“FASB”) Accounting Standard Codification (“ASC”) Topic 820 related to non−financial assets and liabilities as of July 1, 2009. These

assets and liabilities are not measured at fair value on an ongoing basis but are subject to fair value adjustment in certain circumstances.

For the Company these items primarily include long−lived assets, goodwill and intangible assets for which fair value is determined as

part of the related impairment tests and asset retirement obligations initially measured at fair value. At June 30, 2010, there were no

significant adjustments to fair value or fair value measurements required for non−financial assets or liabilities.

Fair value is defined by this accounting standard as the price that would be received to sell an asset or paid to transfer a liability in

an orderly transaction between market participants in the principal market, or if none exists, the most advantageous market, for the

specific asset or liability at the measurement date (the exit price). The fair value should be based on assumptions that market

participants would use when pricing the asset or liability. This accounting standard establishes a fair value hierarchy “the valuation

hierarchy” that prioritizes the information used in measuring fair value as follows:

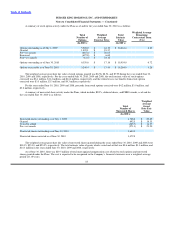

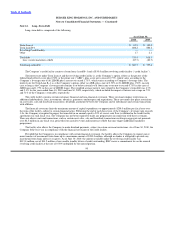

Level 1 Observable inputs that reflect quoted prices (unadjusted) for identical assets or liabilities in

active markets

Level 2 Inputs other than quoted prices included in Level 1 that are observable for the asset or liability

either directly or indirectly

Level 3 Unobservable inputs reflecting management’s own assumptions about the inputs used in pricing

the asset or liability.

Certain of the Company’s derivatives are valued using various pricing models or discounted cash flow analyses that incorporate

observable market parameters, such as interest rate yield curves and currency rates, classified as Level 2 within the valuation hierarchy.

Derivative valuations incorporate credit risk adjustments that are necessary to reflect the probability of default by the counterparty or

the Company.

The carrying amounts for cash and equivalents, trade accounts and notes receivable and accounts and drafts receivable

approximate fair value based on the short−term nature of these accounts.

Restricted investments, consisting of investment securities held in a rabbi trust to invest compensation deferred under the

Company’s Executive Retirement Plan and fund future deferred compensation obligations, are carried at fair value, with net unrealized

gains and losses recorded in the Company’s consolidated statements of income. The fair value of these investment securities are

determined using quoted market prices in active markets classified as Level 1 within the fair value hierarchy.

Fair value of variable rate term debt was estimated using inputs based on bid and offer prices and are Level 2 inputs within the fair

value hierarchy.

80