Burger King 2010 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2010 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

of changes to our property portfolio in the U.S. & Canada segment, which includes the impact of refranchisings of Company restaurants

and opening new restaurants leased to franchisees. These factors were partially offset by decreased rent expense from a reduction in the

number of properties leased to franchisees in EMEA.

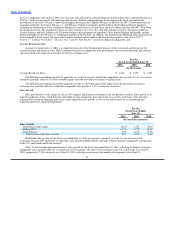

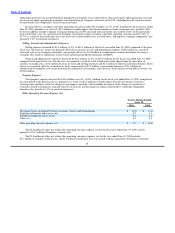

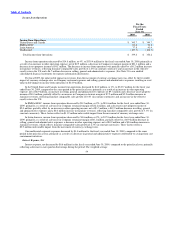

Other operating (income) expense, net

For the

Fiscal Years

Ended

June 30,

2010 2009

Net (gains) losses on disposal of assets restaurant closures and refranchisings $ (2.4) $ (8.5)

Litigation settlements and reserves, net (0.2) 0.2

Foreign exchange net (gains) losses (3.3) 8.4

Other, net 5.2 1.8

Other operating (income) expense, net $ (0.7) $ 1.9

The $5.2 million of other, net within other operating (income) expense, net for fiscal year ended June 30, 2010 includes a

$2.4 million charge related to consumption tax in EMEA, $1.5 million of severance costs related to refranchisings in Germany,

$1.0 million of franchise workout costs and a $0.7 million contract termination fee, partially offset by $1.1 million of income recorded

in connection with the expiration of gift cards in the U.S.

The $1.8 million of other, net within other operating (income) expense, net for the fiscal year ended June 30, 2009 consists

primarily of $1.7 million of franchise workout costs.

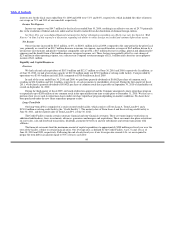

Income from Operations

For the

Fiscal Years

Ended

June 30,

2010 2009

Income from Operations:

United States and Canada $ 346.7 $ 345.7

EMEA/APAC 84.6 83.6

Latin America 38.2 37.8

Unallocated (136.6) (127.7)

Total income from operations $ 332.9 $ 339.4

Income from operations decreased by $6.5 million, or 2%, to $332.9 million during the fiscal year ended June 30, 2010, compared

to the prior fiscal year, primarily as a result of a decrease in Company restaurant margin of $12.3 million, a $1.5 million increase in

selling, general and administrative expenses and a reduction in net property revenue of $1.1 million, partially offset by a $5.8 million

increase in franchise revenues and a $2.6 million decrease in other operating expense, net. (See Note 23 to our audited consolidated

financial statements for segment information disclosures).

For the fiscal year ended June 30, 2010, the favorable impact on revenues from the movement of currency exchange rates was

partially offset by the unfavorable impact of currency exchange rates on Company restaurant expenses and selling, general and

administrative expenses, resulting in a net favorable impact on income from operations of $1.4 million.

In the U.S. and Canada, income from operations increased by $1.0 million, or 0.3%, to $346.7 million during the fiscal year ended

June 30, 2010, compared to the prior fiscal year, primarily as a result of a decrease in selling, general and administrative expenses of

$5.8 million, a decrease in other operating expense, net of $4.9 million and an increase in Company restaurant margin of $0.4 million.

These factors were partially offset by a

53