Burger King 2010 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2010 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

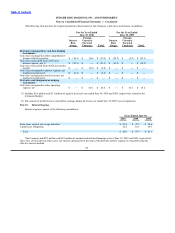

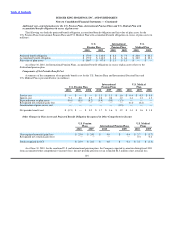

The Company’s total minimum obligations under capital leases are $134.1 million and $138.1 million as of June 30, 2010 and

2009, respectively. Of these amounts, $63.2 million and $67.5 million represents interest as of June 30, 2010 and 2009, respectively.

The remaining balance of $70.9 million and $70.6 million is reflected as capital lease obligations recorded in the Company’s

consolidated balance sheet, of which $5.6 million and $4.8 million is classified as current portion of long−term debt and capital leases

as of June 30, 2010 and 2009, respectively.

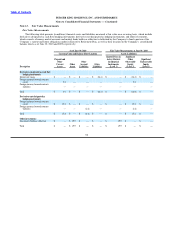

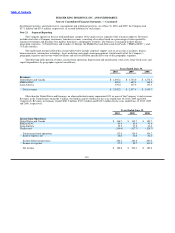

Property revenues are comprised primarily of rental income from operating leases and earned income on direct financing leases

with franchisees as follows (in millions):

Years Ended June 30,

2010 2009 2008

Rental income:

Minimum $ 73.1 $ 69.9 $ 78.9

Contingent 17.9 20.6 20.7

Total rental income 91.0 90.5 99.6

Earned income on direct financing leases 22.7 23.0 22.0

Total property revenues $ 113.7 $ 113.5 $ 121.6

Rent expense associated with the lease commitments is as follows (in millions):

Years Ended June 30,

2010 2009 2008

Rental expense:

Minimum $ 168.9 $ 166.5 $ 150.2

Contingent 7.4 7.7 7.4

Amortization of favorable and unfavorable leases contracts, net (15.0) (18.2) (24.2)

Total rental expense $ 161.3 $ 156.0 $ 133.4

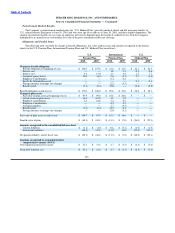

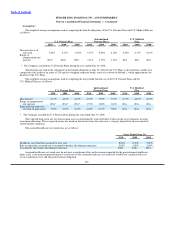

Favorable leases are amortized on a straight line basis over the remaining lease term for a period of up to 20 years, with

amortization expense included in occupancy and other operating costs and property expenses in the consolidated statements of income.

Unfavorable leases are amortized over a period of up to 20 years as a reduction in occupancy and other operating costs and property

expenses in the consolidated statements of income.

Amortization of favorable leases totaled $2.6 million, $2.6 million and $1.8 million for the years ended June 30, 2010, 2009 and

2008, respectively. Amortization of unfavorable leases totaled $17.6 million, $20.8 million and $26.0 million for the years ended

June 30, 2010, 2009 and 2008, respectively.

Favorable leases, net of accumulated amortization totaled $34.4 million and $36.5 million as of June 30, 2010 and June 30, 2009,

respectively, and are classified as intangible assets in the accompanying consolidated balance sheets. Unfavorable leases, net of

accumulated amortization totaled $127.3 million and $155.5 million as of June 30, 2010 and June 30, 2009, respectively, and are

classified within other liabilities in the accompanying consolidated balance sheets.

As of June 30, 2010, estimated future amortization expense of favorable lease contracts subject to amortization for each of the

years ended June 30 is $2.6 million in 2011, $2.5 million in 2012, $2.6 million in 2013, $2.4 million in 2014, $2.3 million in 2015 and

$22.1 million thereafter. As of June 30, 2010, estimated future amortization expense of unfavorable lease contracts subject to

amortization for each of the years ended June 30 is $15.1 million in 2011, $14.1 million in 2012, $13.3 million in 2013, $12.4 million in

2014, $11.2 million in 2015 and $61.3 million thereafter.

101