Burger King 2010 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2010 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Critical Accounting Policies and Estimates

This discussion and analysis of financial condition and results of operations is based on our consolidated financial statements,

which have been prepared in accordance with U.S. generally accepted accounting principles. The preparation of these financial

statements requires our management to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues,

and expenses, as well as related disclosures of contingent assets and liabilities. We evaluate our estimates on an ongoing basis and we

base our estimates on historical experience and various other assumptions we deem reasonable to the situation. These estimates and

assumptions form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from

other sources. Volatile credit, equity, foreign currency and energy markets, and declines in consumer spending have increased and may

continue to create uncertainty inherent in such estimates and assumptions. As future events and their effects cannot be determined with

precision, actual results could differ significantly from these estimates. Changes in our estimates could materially impact our results of

operations and financial condition in any particular period.

We consider our critical accounting policies and estimates to be as follows based on the high degree of judgment or complexity in

their application:

Long−lived Assets

Long−lived assets (including definite−lived intangible assets) are tested for impairment whenever events or changes in

circumstances indicate that the carrying amount of an asset may not be recoverable. We review our long−lived assets for indications of

impairment on a quarterly basis. Some of the events or changes in circumstances that would trigger an impairment test include, but are

not limited to:

• significant under−performance relative to expected and/or historical results (negative comparable sales

growth or operating cash flows for two consecutive years);

• significant negative industry or economic trends;

• knowledge of transactions involving the sale of similar property at amounts below our carrying value; or

• our expectation to dispose of long−lived assets before the end of their estimated useful lives, even though

the assets do not meet the criteria to be classified as “held for sale.”

The impairment test for long−lived assets requires us to assess the recoverability of our long−lived assets by comparing their net

carrying value to the sum of undiscounted estimated future cash flows directly associated with and arising from our use and eventual

disposition of the assets. If the net carrying value of a group of long−lived assets exceeds the sum of related undiscounted estimated

future cash flows, we would be required to record an impairment charge equal to the excess, if any, of net carrying value over fair value.

When assessing the recoverability of our long−lived assets, we make assumptions regarding estimated future cash flows and other

factors. Some of these assumptions involve a high degree of judgment and also bear a significant impact on the assessment conclusions.

Included among these assumptions are estimating undiscounted future cash flows, including the projection of comparable sales,

restaurant operating expenses, capital requirements for maintaining property and equipment and residual value of asset groups. We

formulate estimates from historical experience and assumptions of future performance, based on business plans and forecasts, recent

economic and business trends, and competitive conditions. In the event that our estimates or related assumptions change in the future,

we may be required to record an impairment charge.

See Note 2 to our audited Consolidated Financial Statements included in Part II, Item 8 of this Form 10−K for additional

information about accounting for long−lived assets.

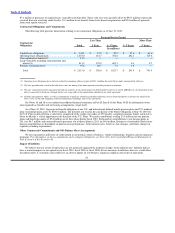

Goodwill and Indefinite−lived Intangible Assets

Goodwill represents the excess of the purchase price over the fair value of assets acquired and liabilities assumed in our

acquisitions of franchise restaurants, predominately in the United States, which are accounted for as business combinations. Our

indefinite−lived intangible asset consists of the Burger King brand (the “Brand”).

We test goodwill and the Brand for impairment on an annual basis and more often if an event occurs or circumstances change that

indicates impairment might exist.

64