Burger King 2010 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2010 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

(as defined in the Credit Facility) for such fiscal year. To date, we have not been required to make any prepayments in connection with

these covenants as a result of our leverage ratio. There are other events and transactions, such as certain asset sales, sale and leaseback

transactions resulting in aggregate net proceeds over $2.5 million in any fiscal year, proceeds from casualty events and incurrence of

debt that may trigger additional mandatory prepayment.

The Credit Facility also allows us to make dividend payments, subject to certain covenant restrictions. As of June 30, 2010, we

were in compliance with the financial covenants of the Credit Facility.

As of June 30, 2010, we held interest rate swaps with an aggregate notional value of $575.0 million, which are linked to the

maturities of Term Loan A and Term Loan B−1 and swap the LIBOR−based floating rate interest payments due under this indebtedness

for fixed interest rates. The weighted average interest rate on our term debt for fiscal 2010 was 4.7%, which included on average the

impact of interest rate swaps on 73% of our debt.

Expected Refinancing

As of June 30, 2010, we had total indebtedness under the Credit Facility of $753.7 million, of which $87.5 million is under Term

Loan A and $666.2 million is under Term Loan B−1. As discussed above, the maturity date of Term Loan A and any future amounts

borrowed under our revolving credit facility is June 30, 2011, and the maturity date of Term Loan B−1 is June 30, 2012. Since the

collateral for the indebtedness under our Credit Facility is the same for Term Loan A and Term Loan B−1, we expect to refinance Term

Loan B−1 at the same time as Term Loan A. Accordingly, we anticipate refinancing all the indebtedness under our Credit Facility

before June 30, 2011.

In the event we refinance this indebtedness before its maturity, we may not be able to re−designate the current interest rate swaps,

which are linked to the maturities of our senior debt, as accounting hedges for new floating rate obligations, or the swap instruments

may be contractually terminated by our counterparties. At June 30, 2010, our aggregate obligation resulting from the interest rate swaps

was $26.1 million. In the event we are unable to re−designate our existing interest rate swap instruments as accounting hedges for new

floating rate obligations, or in the event that the instruments’ counterparties exercise their right to terminate the swap instruments, we

could be required to accelerate the income statement recognition of this obligation at that time, accelerate cash payments to

counterparties, or both.

Our revolving credit facility provides for the issuance of letters of credit and at June 30, 2010, we had $34.2 million of irrevocable

standby letters of credit outstanding under the revolving credit facility. The beneficiaries under these letters of credit generally require

expiration dates of one year. Since our revolving credit facility is scheduled to mature within one year, letter of credit beneficiaries

could require us to provide cash deposits to replace the standby letters of credit we issued under our revolving credit facility. In such a

case we would need to dedicate a significant amount of cash to satisfy these obligations, which would reduce the capital available for

our strategic initiatives and other purposes.

Current economic conditions have adversely affected the availability, cost and terms of debt financing. We anticipate refinancing

our Credit Facility before the maturity date in June 2011. There can be no assurance that we will be able to refinance the facility on

terms as favorable as our current facility on commercially acceptable terms, or at all. Accordingly, while we expect cash on hand, cash

flow from operations and our borrowing capacity under current and expected credit facilities will allow us to meet cash requirements,

including capital expenditures, tax payments, dividends, debt service payments and share repurchases, if any, over the next twelve

months and for the foreseeable future, until we complete a refinancing of this facility, it will be difficult to predict our borrowing

capacity and interest costs for future periods. In the event that we require additional funds for strategic initiatives or other corporate

purposes, we could incur additional debt or raise funds through the issuance of our equity securities.

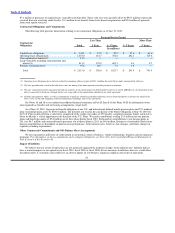

Comparative Cash Flows

Operating Activities

Cash provided by operating activities was $310.4 million in fiscal 2010, compared to $310.8 million in fiscal 2009. The

$310.4 million provided in fiscal 2010 includes net income of $186.8 million, including non−cash items such as depreciation and

amortization of $111.7 million, a $40.9 million loss on the remeasurement of foreign denominated assets and stock based compensation

of $17.0 million, partially offset by $9.5 million gains on

61