Burger King 2010 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2010 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

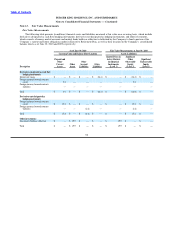

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

For the years ended June 30, 2010, 2009 and 2008, the fair value of shares withheld by the Company to meet employees’

minimum statutory withholding tax requirements on the settlement of RSU’s was $2.7 million, $0.3 million, and $4.1 million,

respectively.

Note 4. Acquisitions, Closures and Dispositions

Acquisitions

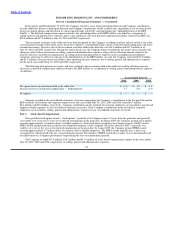

Acquisitions are summarized as follows (in millions, except for number of restaurants):

Years Ended June 30,

2010 2009 2008

Number of restaurants acquired 39 87 83

Prepaids and other current assets $ 1.8 $ 1.0 $ 1.0

Property and equipment, net 4.9 14.6 13.3

Goodwill and other intangible assets 7.6 55.7 47.5

Other assets, net 2.1 — —

Assumed liabilities (2.4) (3.4) (7.6)

Total purchase price $ 14.0 $ 67.9 $ 54.2

Closures and Dispositions

Gains and losses on closures and dispositions represent sales of Company properties and other costs related to restaurant closures

and sales of Company restaurants to franchisees, referred to as “refranchisings,” and are recorded in other operating (income) expenses,

net in the accompanying consolidated statements of income. Gains and losses recognized in the current period may reflect closures and

refranchisings that occurred in previous periods.

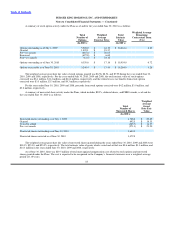

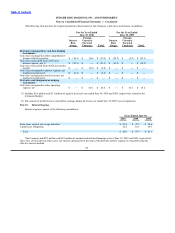

Closures and dispositions are summarized as follows (in millions, except for number of restaurants):

Years Ended June 30,

2010 2009 2008

Number of restaurant closures 34 19 29

Number of refranchisings 91 51 38

Net gain on restaurant closures, refranchisings and dispositions of assets $ (2.4) $ (8.5) $ (9.8)

Included in the net gain on restaurant closures, refranchisings and dispositions of assets for the years ended June 30, 2010 and

2009 is a $2.3 million and $5.4 million gain, respectively, from the refranchising of Company restaurants in the U.S. and Germany.

Included in the net gain on restaurant closures, refranchisings and dispositions of assets for the year ended June 30, 2008 is a

$9.0 million gain from the refranchising of Company restaurants, primarily in Germany.

86