Burger King 2010 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2010 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

In the quarter ended September 30, 2009, the Company elected to cease future participant deferrals and Company contributions

into the rabbi trust; however, participant deferrals and Company contributions will be credited with a hypothetical rate of return based

on the investment options and allocations in various mutual funds selected by each participant (the “unfunded portion of the ERP

liability”). The deferred compensation expense related to the unfunded portion of the ERP liability is included as a component of

selling, general and administrative expenses and was not significant. The total deferred compensation liability related to the ERP was

$22.6 million and $17.9 million at June 30, 2010 and 2009, respectively.

The investment securities in the rabbi trust have been designated by the Company as trading securities and are carried at fair value

as restricted investments within other assets, net in the Company’s consolidated balance sheets, with unrealized trading gains and losses

recorded in earnings. The fair value of the investment securities held in the rabbi trust was $19.9 million and $17.9 million as of

June 30, 2010 and 2009, respectively. During the current fiscal year, the Company began recording the net (gains) losses related to the

change in value of these investments in selling, general and administrative expenses, along with an offsetting amount related to the

increase (decrease) in deferred compensation, in selling, general and administrative expenses in the accompanying consolidated

statements of income to reflect its exposure to the funded portion of the ERP liability. As such, the Company reclassified $3.9 million

and $1.5 million of loss previously recorded in other operating (income) expenses, net to selling, general and administrative expenses

for the fiscal years ended June 30, 2009 and 2008, respectively.

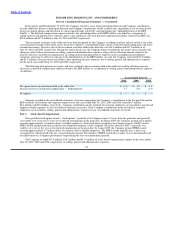

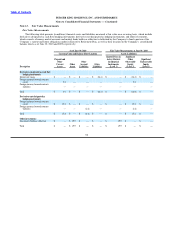

The following table presents net (gains) and losses related to the investments held in the rabbi trust and the offsetting increase

(decrease) in deferred compensation expense related to the ERP liability as a component of selling, general and administrative expenses

(in millions):

Years Ended June 30,

2010 2009 2008

Net (gains) losses on investments held in the rabbi trust $ (3.7) $ 3.9 $ 1.5

Increase (decrease) in deferred compensation — funded portion 3.7 (3.9) (1.5)

Net impact $ — $ — $ —

Amounts recorded in the consolidated statements of income representing the Company’s contributions to the Savings Plan and the

ERP on behalf of restaurant and corporate employees for the years ended June 30, 2010, 2009 and 2008 totaled $6.7 million,

$6.4 million and $6.9 million, respectively. Company contributions made on behalf of restaurant employees are classified as payroll and

employee benefit expenses in our consolidated statements of income, while Company contributions made on behalf of corporate

employees are classified as selling, general and administrative expenses in our consolidated statements of income.

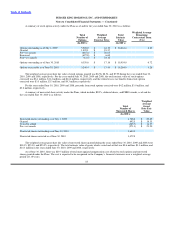

Note 3. Stock−based Compensation

Non−qualified stock option awards (“stock options”) granted by the Company expire 10 years from the grant date and generally

vest ratably over a four to five−year service period commencing on the grant date. In August 2009, the Company granted stock options

covering approximately 1.8 million shares to eligible employees. Nonvested shares granted by the Company consist of RSU awards,

PBRS awards and deferred shares issued to non−employee members of the Company’s Board of Directors. RSU’s generally vest

ratably over a two to five year service period commencing on the grant date. In August 2009, the Company granted PBRS awards

covering approximately 0.7 million shares of common stock to eligible employees. The PBRS awards typically have a three year

vesting period, which includes the one−year performance period. The number of PBRS awards that actually vest are determined based

on achievement of a Company performance target during the one−year performance period.

The Company recorded $17.0 million, $16.2 million and $11.4 million of stock−based compensation expense in the years ended

June 30, 2010, 2009 and 2008, respectively, in selling, general and administrative expenses.

83