Burger King 2010 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2010 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

refranchising and asset dispositions. In addition, cash provided by operating activities was offset by a usage of cash from a change in

working capital of $54.0 million and $1.5 million change in other long term assets and liabilities.

The $310.8 million provided in fiscal 2009 includes net income of $200.1 million, including non−cash items such as depreciation

and amortization of $98.1 million and a $50.1 million loss on the remeasurement of foreign denominated assets and stock based

compensation of $16.2 million, as well as a $3.8 million change in other long term assets and liabilities. In addition, cash provided by

operating activities was offset by a usage of cash from a change in working capital of $58.5 million. The $58.5 million of cash used

from the change in working capital is primarily due to the timing of tax payments, including benefits derived from the dissolution of

dormant foreign entities.

Investing Activities

Cash used for investing activities was $134.9 million in fiscal 2010, compared to $242.0 million in fiscal 2009. The $134.9 million

of cash used in fiscal 2010 includes $150.3 million of payments for property and equipment and $14.0 million used for the acquisition

of franchised restaurants, partially offset by proceeds received from refranchisings, dispositions of assets and restaurant closures of

$21.5 million and $8.2 million of principal payments received on direct financing leases.

The $242.0 million of cash used in fiscal 2009 includes $204.0 million of payments for property and equipment, $67.9 million

used for the acquisition of franchised restaurants and $4.4 million used for other investing activities, partially offset by proceeds

received from refranchisings, dispositions of assets and restaurant closures of $26.4 million and $7.9 million of principal payments

received on direct financing leases.

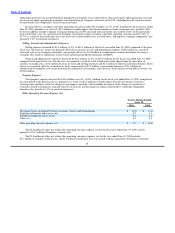

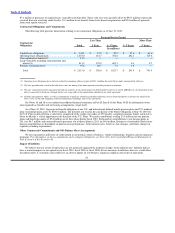

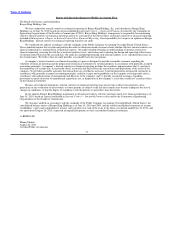

Capital expenditures for new restaurants include the costs to build new Company restaurants as well as properties for new

restaurants that we lease to franchisees. Capital expenditures for existing restaurants consist of the purchase of real estate related to

existing restaurants, as well as renovations to Company restaurants, including restaurants acquired from franchisees, investments in new

equipment and normal annual capital investments for each Company restaurant to maintain its appearance in accordance with our

standards. Capital expenditures for existing restaurants also include investments in improvements to properties we lease and sublease to

franchisees, including contributions we make toward leasehold improvements completed by franchisees on properties we own. Other

capital expenditures include investments in information technology systems and corporate furniture and fixtures. The following table

presents capital expenditures by type of expenditure:

For the

Fiscal Years Ended

June 30,

2010 2009 2008

(In millions)

New restaurants $ 41.1 $ 65.4 $ 55.4

Existing restaurants 91.7 110.1 102.0

Other, including corporate 17.5 28.5 20.8

Total $ 150.3 $ 204.0 $ 178.2

For fiscal 2011, we expect capital expenditures of approximately $175 million to $200 million to develop new restaurants and

properties, to fund our restaurant reimaging program and to make improvements to restaurants we acquire, for operational initiatives in

our restaurants and for other corporate expenditures.

Financing Activities

Cash used by financing activities was $96.9 million in fiscal 2010, compared to $105.5 million in fiscal 2009. The $96.9 million

of cash used includes $67.7 million of payments on capital leases, term debt and other debt, $38.5 million of payments on our revolving

credit facility, payment of four quarterly cash dividends totaling $34.2 million and stock repurchases of $2.7 million. These cash uses

were partially offset by $38.5 million of proceeds received from our revolving credit facility, $3.5 million in tax benefits from

stock−based compensation and $4.2 million of proceeds from stock option exercises.

The $105.5 million of cash used in fiscal 2009 includes $144.3 million of payments on our revolving credit facility, payment of

four quarterly cash dividends totaling $34.1 million, stock repurchases of $20.3 million and

62