Burger King 2010 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2010 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

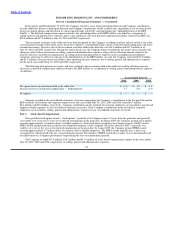

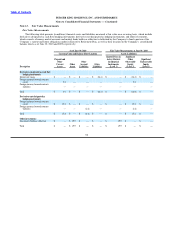

Note 13. Fair Value Measurements

Fair Value Measurements

The following table presents (in millions) financial assets and liabilities measured at fair value on a recurring basis, which include

derivatives designated as cash flow hedging instruments, derivatives not designated as hedging instruments, and other investments,

which consists of money market accounts and mutual funds held in a rabbi trust established by the Company to fund a portion of the

Company’s current and future obligations under its Executive Retirement Plan, as well as their location on the Company’s consolidated

balance sheets as of June 30, 2010 and 2009 respectively:

As of June 30, 2010 Fair Value Measurements at June 30, 2010

Carrying Value and Balance Sheet Location Assets (Liabilities)

Quoted Prices in Significant

Prepaid and Active Markets Other Significant

Other Other for Identical Observable Unobservable

Current Other Accrued Other Instruments Inputs Inputs

Description Assets Assets Liabilities Liabilities (Level 1) (Level 2) (Level 3)

Derivatives designated as cash flow

hedging instruments:

Interest rate swaps $ — $ — $ — $ (26.1) $ — $ (26.1) $ —

Foreign currency forward contracts

(asset) 0.1 — — — — 0.1 —

Foreign currency forward contracts

(liability) — — — — — — —

Total $ 0.1 $ — $ — $ (26.1) $ — $ (26.0) $ —

Derivatives not designated as

hedging instruments:

Foreign currency forward contracts

(asset) $ 25.8 $ — $ — $ — $ — $ 25.8 $ —

Foreign currency forward contracts

(liability) — — (2.6) — — (2.6) —

Total $ 25.8 $ — $ (2.6) $ — $ — $ 23.2 $ —

Other investments:

Investments held in a rabbi trust $ — $ 19.9 $ — $ — $ 19.9 $ — $ —

Total $ — $ 19.9 $ — $ — $ 19.9 $ — $ —

92