Burger King 2010 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2010 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

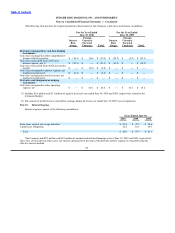

fixed payments with contingent rent when sales exceed certain levels. Lease terms generally range from 10 to 20 years. The franchisees

bear the cost of maintenance, insurance and property taxes.

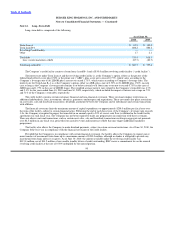

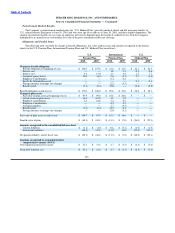

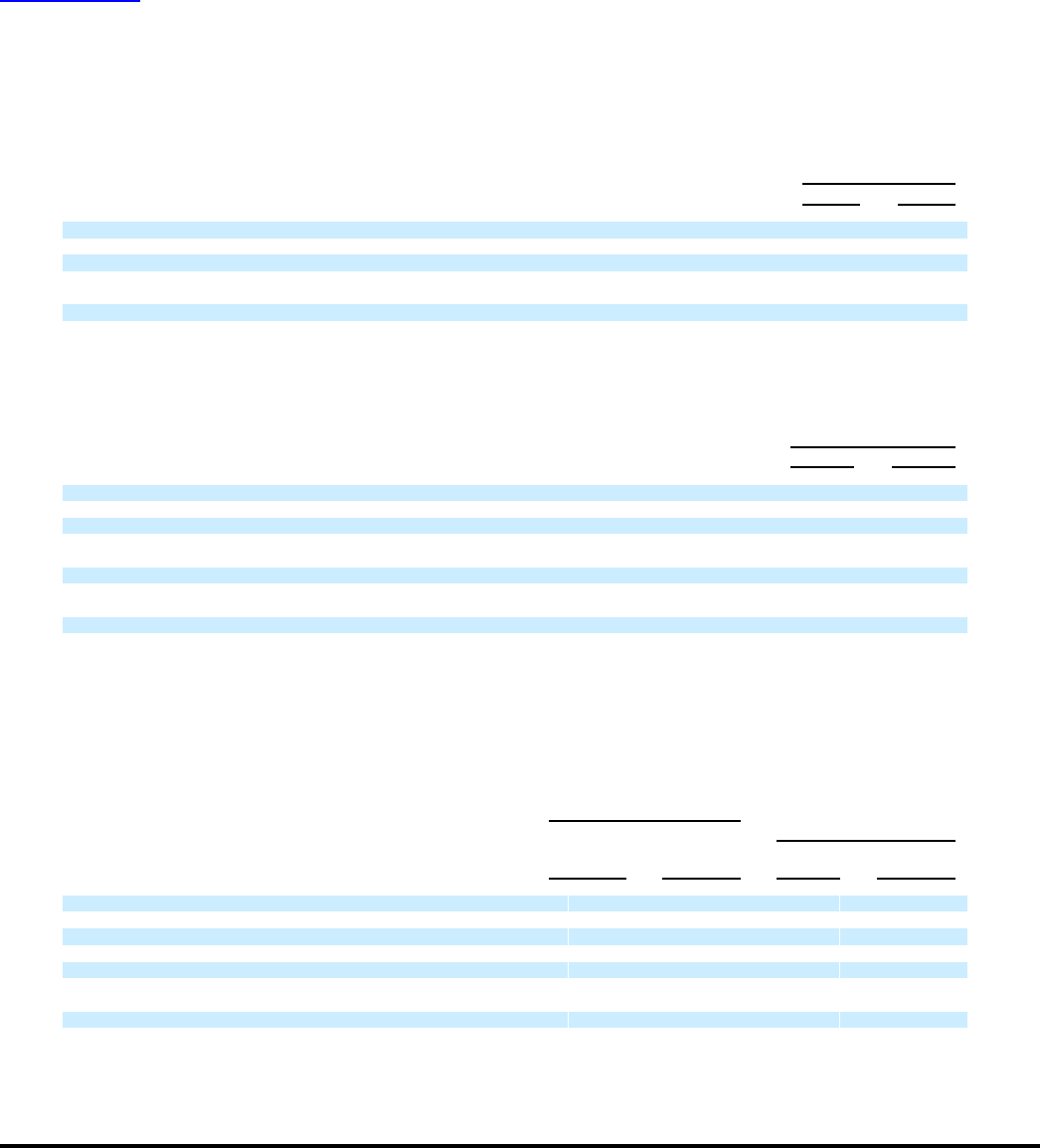

Property and equipment, net leased to franchisees and other third parties under operating leases was as follows (in millions):

As of June 30,

2010 2009

Land $ 198.3 $ 195.8

Buildings and improvements 79.6 114.0

Restaurant equipment 8.1 5.1

$ 286.0 $ 314.9

Accumulated depreciation (70.5) (40.9)

$ 215.5 $ 274.0

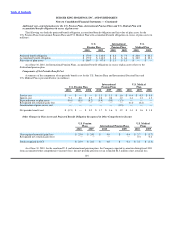

Net investment in property leased to franchisees and other third parties under direct financing leases was as follows (in millions):

As of June 30,

2010 2009

Future minimum rents to be received $ 316.6 $ 306.4

Estimated unguaranteed residual value 3.7 4.0

Unearned income (172.3) (166.2)

Allowance on direct financing leases (0.6) (0.2)

$ 147.4 $ 144.0

Current portion included within trade receivables (8.9) (8.7)

Net investment in property leased to franchisees $ 138.5 $ 135.3

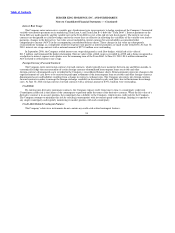

In addition, the Company is the lessee on land, building, equipment, office space and warehouse leases, including 259 restaurant

buildings under capital leases. Initial lease terms are generally 10 to 20 years. Most leases provide for fixed monthly payments. Many of

these leases provide for future rent escalations and renewal options. Certain leases require contingent rent, determined as a percentage

of sales, generally when annual sales exceed specific levels. Most leases also obligate the Company to pay the cost of maintenance,

insurance and property taxes.

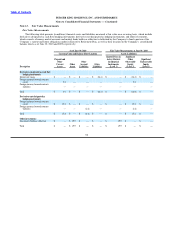

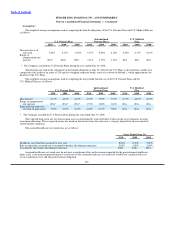

As of June 30, 2010, future minimum lease receipts and commitments were as follows (in millions):

Lease Receipts

Direct Lease Commitments(a)

Financing Operating Capital Operating

Leases Leases Leases Leases

2011 $ 29.9 $ 67.8 $ (15.2) $ (161.7)

2012 29.3 62.9 (14.9) (156.9)

2013 28.8 60.3 (14.8) (144.7)

2014 27.6 58.2 (14.8) (136.5)

2015 27.0 51.3 (12.8) (125.6)

Thereafter 174.0 335.3 (61.6) (729.6)

Total $ 316.6 $ 635.8 $ (134.1) $ (1,455.0)

(a) Lease commitments under operating leases have not been reduced by minimum sublease rentals of $343.1 due in the future under

noncancelable subleases.

100