Burger King 2010 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2010 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

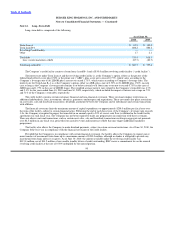

Revenue Recognition

Revenues include retail sales at Company restaurants and franchise and property revenues. Franchise revenues include royalties

and initial and renewal franchise fees. Property revenues include rental income from operating lease rentals and earned income on direct

financing leases on property leased or subleased to franchisees. Retail sales at Company restaurants are recognized at the point of sale

and royalties from franchisees are based on a percentage of retail sales reported by franchisees. The Company presents sales net of sales

tax and other sales−related taxes. Royalties are recognized when collectibility is reasonably assured. Initial franchise fees are

recognized as revenue when the related restaurant begins operations. A franchisee may pay a renewal franchise fee and renew its

franchise for an additional term. Renewal franchise fees are recognized as revenue upon receipt of the non−refundable fee and

execution of a new franchise agreement. The cost recovery accounting method is used to recognize revenues for franchisees for whom

collectibility is not reasonably assured. Rental income on operating lease rentals and earned income on direct financing leases are

recognized when collectibility is reasonably assured.

Advertising and Promotional Costs

The Company expenses the production costs of advertising when the advertisements are first aired or displayed. All other

advertising and promotional costs are expensed in the period incurred.

Franchise restaurants and Company restaurants contribute to advertising funds managed by the Company in the United States and

certain international markets where Company restaurants operate. Under the Company’s franchise agreements, contributions received

from franchisees must be spent on advertising, marketing and related activities, and result in no gross profit recognized by the

Company. Advertising expense, net of franchisee contributions, totaled $91.3 million for the year ended June 30, 2010, $93.3 million

for the year ended June 30, 2009, and $91.5 million for the year ended June 30, 2008, and is included in selling, general and

administrative expenses in the accompanying consolidated statements of income.

To the extent that contributions received exceed advertising and promotional expenditures, the excess contributions are accounted

for as a deferred liability and are recorded in accrued advertising in the accompanying consolidated balance sheets.

Franchisees in markets where no Company restaurants operate contribute to advertising funds not managed by the Company. Such

contributions and related fund expenditures are not reflected in the Company’s results of operations or financial position.

Income Taxes

Amounts in the financial statements related to income taxes are calculated using the principles of FASB ASC Topic 740, “Income

Taxes.” Under these principles, deferred tax assets and liabilities reflect the impact of temporary differences between the amounts of

assets and liabilities recognized for financial reporting purposes and the amounts recognized for tax purposes, as well as tax credit

carryforwards and loss carryforwards. These deferred taxes are measured by applying currently enacted tax rates. A deferred tax asset is

recognized when it is considered more likely than not to be realized. The effects of changes in tax rates on deferred tax assets and

liabilities are recognized in income in the year in which the law is enacted. A valuation allowance reduces deferred tax assets when it is

more likely than not that some portion or all of the deferred tax assets will not be recognized.

Income tax benefits credited to stockholders’ equity relate to tax benefits associated with amounts that are deductible for income

tax purposes but do not affect earnings. These benefits are principally generated from employee exercises of nonqualified stock options

and settlement of restricted stock awards.

The Company recognizes positions taken or expected to be taken in a tax return, in the financial statements when it is more likely

than not (i.e., a likelihood of more than fifty percent) that the position would be sustained

81