Burger King 2010 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2010 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

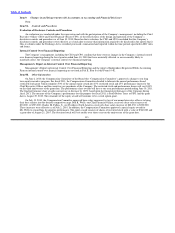

Postretirement Medical Benefits

The Company’s postretirement medical plan (the “U.S. Medical Plan”) provides medical, dental and life insurance benefits to

U.S. salaried retirees hired prior to June 30, 2001 and who were age 40 or older as of June 30, 2001, and their eligible dependents. The

amount of retirement health care coverage an employee will receive depends upon the length of credited service with the Company,

multiplied by an annual factor to determine the value of the post−retirement health care coverage.

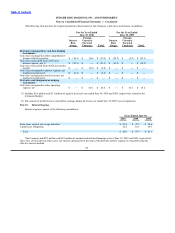

Obligations and Funded Status

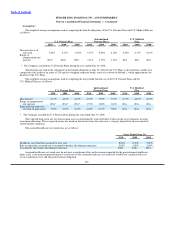

The following table sets forth the change in benefit obligations, fair value of plan assets and amounts recognized in the balance

sheets for the U.S. Pension Plans, International Pension Plans and U.S. Medical Plan (in millions):

U.S. International U.S.

Pension Plan Pension Plans Medical Plan

2010 2009 2010 2009 2010 2009

Change in benefit obligation

Benefit obligation at beginning of year $ 146.0 $ 147.8 $ 23.6 $ 27.0 $ 22.1 $ 22.3

Service cost — — 1.8 2.1 0.4 0.6

Interest cost 9.1 11.0 1.3 1.6 1.3 1.7

Actuarial (gains) losses 29.0 (6.4) 5.6 (3.3) 2.7 (1.8)

Employee Contributions — — 0.2 0.3 — —

Part D Rx Subsidy Received — — — — 0.1 0.1

Foreign currency exchange rate changes — — (2.3) (4.1) — —

Benefits paid (5.1) (6.4) (0.6) — (0.6) (0.8)

Benefit obligation at end of year $ 179.0 $ 146.0 $ 29.6 $ 23.6 $ 26.0 $ 22.1

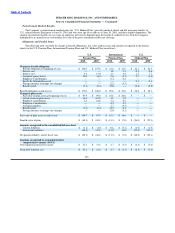

Change in plan assets

Fair value of plan assets at beginning of year $ 97.9 $ 99.0 $ 16.6 $ 20.8 $ — $ —

Actual return on plan assets 14.6 (19.5) 1.1 1.2 — —

Employer contributions 2.3 24.8 1.2 0.9 — —

Employee Contributions — — 0.2 0.3 — —

Actuarial gain/loss — — 1.7 (3.5) — —

Benefits paid (5.1) (6.4) (0.5) 0.1 — —

Foreign currency exchange rate changes — — (2.0) (3.2) — —

Fair value of plan assets at end of year $ 109.7 $ 97.9 $ 18.3 $ 16.6 $ — $ —

Funded status of plan $ (69.3) $ (48.1) $ (11.3) $ (7.0) $ (26.0) $ (22.1)

Amounts recognized in the consolidated balance sheet

Current liabilities $ (1.1) $ (1.0) $ (0.1) $ (0.1) $ (1.0) $ (1.0)

Noncurrent liabilities (68.2) (47.1) (11.2) (6.9) (25.0) (21.1)

Net pension liability, end of fiscal year $ (69.3) $ (48.1) $ (11.3) $ (7.0) $ (26.0) $ (22.1)

Amounts recognized in accumulated other

comprehensive income (AOCI)

Unrecognized actuarial loss (gain) $ 55.1 $ 31.2 $ 2.7 $ (1.3) $ (2.3) $ (5.4)

Total AOCI (before tax) $ 55.1 $ 31.2 $ 2.7 $ (1.3) $ (2.3) $ (5.4)

103