Burger King 2010 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2010 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

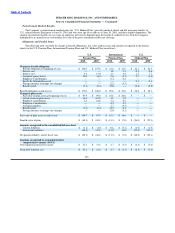

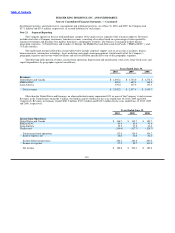

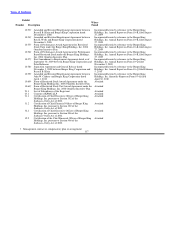

The U.S. and International Pension Plans’ and U.S. Medical Plan’s expected contributions to be paid in the next fiscal year, the

projected benefit payments for each of the next five fiscal years and the total aggregate amount for the subsequent five fiscal years are

as follows:

U.S. International U.S.

Pension Plans Pension Plans Medical Plan*

Estimated Net Contributions During Fiscal 2011: $ 6.1 $ 0.6 $ 1.0

Estimated Future Year Benefit Payments During Years Ended

June 30,:

2011 $ 6.4 $ 0.2 $ 1.0

2012 $ 6.7 $ 0.3 $ 1.3

2013 $ 7.1 $ 0.3 $ 1.4

2014 $ 7.6 $ 0.2 $ 1.6

2015 $ 8.2 $ 0.2 $ 1.7

2016 − 2020 $ 51.9 $ 2.4 $ 10.4

* Net of Part D Subsidy

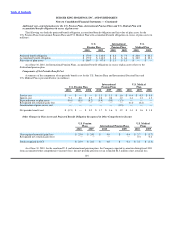

Note 21. Other Operating (Income) Expenses, Net

Other operating (income) expenses, net, consist of the following (in millions):

Years Ended June 30,

2010 2009 2008

Net (gains) losses on disposal of assets restaurant closures and refranchisings $ (2.4) $ (8.5) $ (9.8)

Litigation settlements and reserves, net (0.2) 0.2 1.1

Foreign exchange net (gains) losses (3.3) 8.4 2.3

Other, net 5.2 1.8 5.8

Other operating (income) expense, net $ (0.7) $ 1.9 $ (0.6)

The $5.2 million of other, net within other operating (income) expense, net for fiscal year ended June 30, 2010 includes a

$2.4 million charge related to consumption tax in EMEA, $1.5 million of severance costs related to refranchisings in Germany,

$1.0 million of franchise workout costs and a $0.7 million contract termination fee, partially offset by $1.1 million of income recorded

in connection with the expiration of gift cards in the U.S.

The $1.8 million of other, net within other operating (income) expense, net for the fiscal year ended June 30, 2009 consists

primarily of $1.7 million of franchise workout costs.

The $5.8 million of other, net within other operating (income) expenses, net for the year ended June 30, 2008 includes

$3.1 million of franchise workout costs and $1.9 million of settlement losses associated with the acquisition of franchise restaurants.

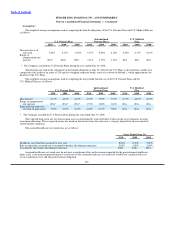

Note 22. Commitments and Contingencies

Guarantees

The Company guarantees certain lease payments of franchisees arising from leases assigned in connection with sales of Company

restaurants to franchisees, by remaining secondarily liable for base and contingent rents under the assigned leases of varying terms. The

maximum contingent rent amount is not determinable as the amount is based on future revenues. In the event of default by the

franchisees, the Company has typically retained the right

107