Berkshire Hathaway 2010 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion (Continued)

Equity Price Risk (Continued)

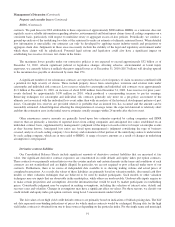

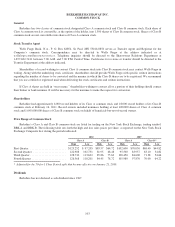

The following table summarizes our equity investments and derivative contract liabilities with equity price risk as of

December 31, 2010 and 2009. The effects of a hypothetical 30% increase and a 30% decrease in market prices as of those dates

is also shown. The selected 30% hypothetical change does not reflect what could be considered the best or worst case scenarios.

Indeed, results could be far worse due both to the nature of equity markets and the aforementioned concentrations existing in

our equity investment portfolio. Dollar amounts are in millions.

Fair Value

Hypothetical

Price Change

Estimated

Fair Value after

Hypothetical

Change in Prices

Hypothetical

Percentage

Increase (Decrease) in

Shareholders’ Equity

December 31, 2010

Equity securities ................................ $61,513 30% increase $ 79,967 7.6

30% decrease 43,059 (7.6)

Other investments (1) ............................. 8,668 30% increase 11,260 1.1

30% decrease 5,956 (1.1)

Equity index put option contracts ................... (6,712) 30% increase (4,687) 0.8

30% decrease (9,859) (1.3)

December 31, 2009

Equity securities ................................ $59,034 30% increase $ 76,744 8.7

30% decrease 41,324 (8.7)

Other investments (1) ............................. 8,011 30% increase 10,696 1.3

30% decrease 5,743 (1.1)

Equity index put option contracts ................... (7,309) 30% increase (5,291) 1.0

30% decrease (10,428) (1.5)

(1) Includes other investments that possess significant equity price risk. Excludes investments accounted for under the equity

method.

Foreign Currency Risk

We generally do not use derivative contracts to hedge foreign currency price changes primarily because of the natural

hedging that occurs between assets and liabilities denominated in foreign currencies in the Consolidated Financial Statements.

Financial statements of subsidiaries that do not use the U.S. Dollar as their functional currency are translated into U.S. Dollars

using period-end exchange rates for assets and liabilities and weighted-average exchange rates for revenues and expenses.

Adjustments resulting from translating the financial statements of these subsidiaries are reported in accumulated other

comprehensive income. Foreign currency transaction gains or losses are included in earnings primarily as a result of the

translation of foreign currency denominated assets and liabilities held by our U.S. subsidiaries. In addition, we hold investments

in major multinational companies that have significant foreign business and foreign currency risk of their own, such as The

Coca-Cola Company.

Our net assets subject to translation are primarily in our insurance and utilities and energy businesses, and to a lesser extent

in our manufacturing and services businesses. The translation impact is somewhat offset by transaction gains or losses on net

reinsurance liabilities of certain U.S. subsidiaries that are denominated in foreign currencies as well as the equity index put

option liabilities of U.S. subsidiaries relating to contracts that would be settled in foreign currencies.

Commodity Price Risk

Through our ownership of MidAmerican, we are subject to commodity price risk. Exposures include variations in the price

of fuel to generate electricity, wholesale electricity that is purchased and sold and natural gas supply for customers. Commodity

prices are subject to wide price swings as supply and demand are impacted by, among many other unpredictable items, weather,

market liquidity, generating facility availability, customer usage, storage and transmission and transportation constraints. To

mitigate a portion of the risk, MidAmerican uses derivative instruments, including forwards, futures, options, swaps and other

agreements, to effectively secure future supply or sell future production generally at fixed prices. The settled cost of these

contracts is generally recovered from customers in regulated rates. Accordingly, net unrealized gains and losses associated with

interim price movements on such contracts are recorded as regulatory assets or liabilities. Financial results would be negatively

95