Berkshire Hathaway 2010 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

(14) Notes payable and other borrowings (Continued)

BHFC is a 100% owned finance subsidiary of Berkshire, which has fully and unconditionally guaranteed its securities.

Debt issued by BHFC matures between 2011 and 2040. During 2010, BHFC issued $750 million par amount of 5.75% senior

notes due in 2040, $250 million par amount of floating rate senior notes due in 2012 and $500 million par amount of 2.45%

senior notes due in 2015. In 2010, $2.0 billion par amount of BHFC senior notes matured and were repaid. In January 2011,

BHFC issued an additional $1.5 billion par amount of notes and repaid $1.5 billion of maturing notes. The new notes are

unsecured and are comprised of $750 million par amount of 4.25% senior notes due in 2021, $375 million par amount of 1.5%

senior notes due in 2014 and $375 million par amount of floating rate senior notes due in 2014.

Prior to our acquisition of Clayton Homes in 2003, certain of its subsidiaries regularly sold their originated and acquired

installment loans to special purpose entities (“SPEs”). The transferred loans were then securitized and sold to third party

investors. We continue to service these installment loans and retain residual interests in the securitized loans. As described in

Note 1(t), ASU 2009-16 eliminated the concept of QSPEs and, in accordance with the requirements of ASU 2009-17, we

reevaluated the SPEs and determined that the SPEs were variable interest entities that should be consolidated under the new

guidance, primarily because we are the servicer of the loans and hold the residual interests. Consequently, as of January 1, 2010,

we increased other borrowings of finance and financial products by approximately $1.5 billion with a corresponding increase in

consumer installment loans receivable. The SPEs continue to be distinct, bankruptcy remote entities that hold the interests in the

related installment loans. The cash flows received from the collection of the installment loans continue to be pledged to satisfy

the principal and interest due on the related debt now recorded in our Consolidated Financial Statements.

Our subsidiaries have approximately $6.2 billion of available unused lines of credit and commercial paper capacity in the

aggregate at December 31, 2010, to support our short-term borrowing programs and provide additional liquidity. Generally,

Berkshire’s guarantee of a subsidiary’s debt obligation is an absolute, unconditional and irrevocable guarantee for the full and

prompt payment when due of all present and future payment obligations.

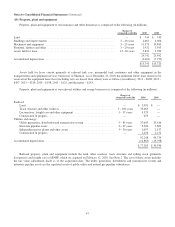

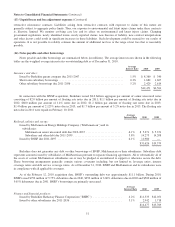

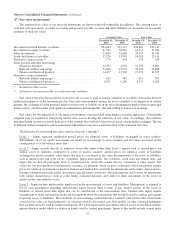

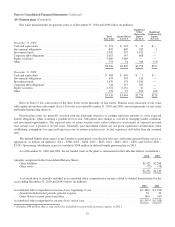

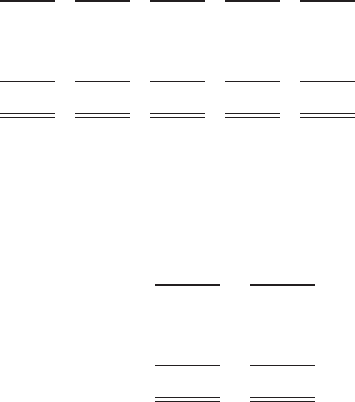

Principal payments expected during the next five years are as follows (in millions).

2011 2012 2013 2014 2015

Insurance and other ................................................. $3,915 $1,880 $2,706 $ 118 $1,921

Railroad, utilities and energy .......................................... 2,162 2,097 1,104 1,618 713

Finance and financial products ......................................... 2,031 2,942 3,658 587 1,658

$8,108 $6,919 $7,468 $2,323 $4,292

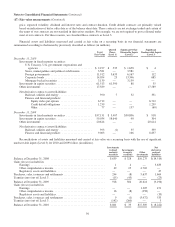

(15) Income taxes

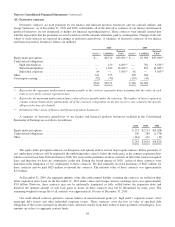

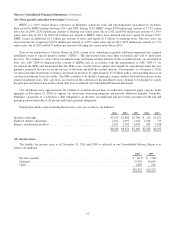

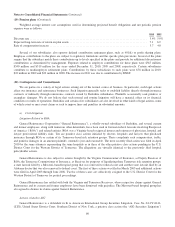

The liability for income taxes as of December 31, 2010 and 2009 as reflected in our Consolidated Balance Sheets is as

follows (in millions).

2010 2009

Payable currently .............................................................. $ (211) $ (396)

Deferred ..................................................................... 35,558 18,695

Other ....................................................................... 1,005 926

$36,352 $19,225

52