Berkshire Hathaway 2010 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

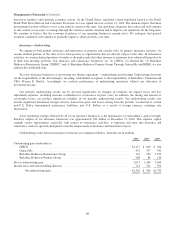

Management’s Discussion (Continued)

Utilities and Energy (“MidAmerican”) (Continued)

options that had been granted to certain members of management at the time of Berkshire’s acquisition of MidAmerican in

2000. EBIT from other activities in 2008 includes approximately $1.1 billion related to our investment in Constellation Energy

and a related breakup fee we received from Constellation Energy.

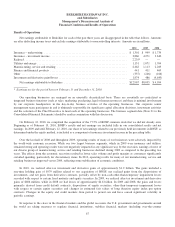

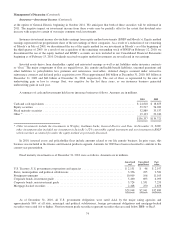

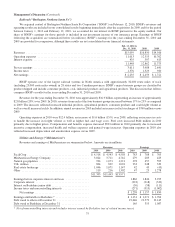

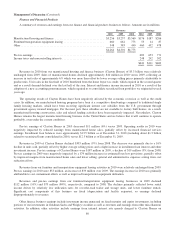

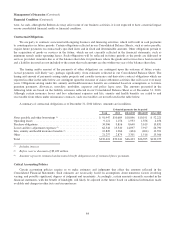

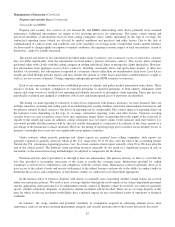

Manufacturing, Service and Retailing

A summary of revenues and earnings of our manufacturing, service and retailing businesses follows. Amounts are

in millions.

Revenues Earnings

2010 2009 2008 2010 2009 2008

Marmon ................................................ $ 5,967 $ 5,067 $ 5,529 $ 813 $ 686 $ 733

McLane Company ........................................ 32,687 31,207 29,852 369 344 276

Other manufacturing ...................................... 17,664 15,937 19,179 1,911 958 1,880

Other service ............................................ 7,355 6,585 8,435 984 (91) 971

Retailing ............................................... 2,937 2,869 3,104 197 161 163

$66,610 $61,665 $66,099

Pre-tax earnings .......................................... $4,274 $2,058 $4,023

Income taxes and noncontrolling interests ..................... 1,812 945 1,740

$2,462 $1,113 $2,283

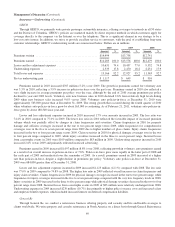

Marmon

We acquired a 60% controlling interest in Marmon Holdings, Inc. (“Marmon”) on March 18, 2008 and as of December 31,

2010 we owned approximately 64% of its outstanding common stock. In the first quarter of 2011, we will acquire additional

shares and increase our ownership interest to about 80.2%. Marmon’s revenues, costs and expenses are included in our

Consolidated Financial Statements beginning as of the initial acquisition date in 2008. Through Marmon, we operate

approximately 130 manufacturing and service businesses that operate independently within eleven diverse business sectors.

Marmon’s revenues in 2010 were $5,967 million, an increase of approximately 18% over 2009. About 40% of the revenues

increase was the result of increased copper prices, the cost of which is passed to customers with little or no margin. The balance

of the revenues increase in 2010 was associated with a gradual rebound in other sectors as Marmon’s end markets improved

from 2009’s low levels. Earnings in 2010 increased $127 million (19%) to $813 million in comparison with 2009. Revenues in

2010 increased in all sectors, except Transportation Services & Engineered Products and Water Treatment sectors. With the

exception of Distribution Services, all sectors had improvement in earnings in 2010. Earnings as a percent of revenues were

13.6% in 2010 and 13.5% in 2009. Operating margins in 2010 were negatively impacted by the increase in copper prices. The

Transportation Services & Engineered Products and Building Wire sectors had the largest increases in earnings in 2010

compared to 2009. Earnings in 2010 also benefitted from lower interest expense.

Revenues in 2009 declined approximately 27% from 2008 (including periods in 2008 prior to our acquisition). The revenue

decline in 2009 reflected the impact of the recession which led to lower customer demand across all sectors, and particularly in

the Building Wire, Engineered Wire & Cable, Flow Products and Distribution Services sectors. Pre-tax earnings in 2009

declined approximately 26% from the full year of 2008 which reflects the decline in revenues, somewhat offset by a

$160 million reduction in operating costs resulting from cost reduction efforts. In 2009, the Retail Store Fixtures, Food Service

Equipment and Water Treatment sectors produced comparable or improved earnings with 2008 despite lower revenues. The

remaining sectors experienced lower earnings in 2009 compared to 2008.

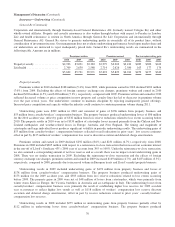

McLane Company

Through McLane, we operate a wholesale distribution business that provides grocery and non-food products to retailers,

convenience stores and restaurants. McLane’s business is marked by high sales volume and very low profit margins, and the

fact that about 30% of its annual revenues are from sales to Wal-Mart. A curtailment of purchasing by Wal-Mart could have a

77