Berkshire Hathaway 2010 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

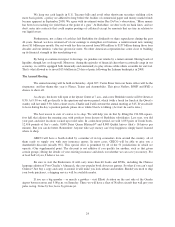

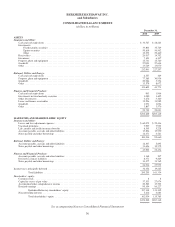

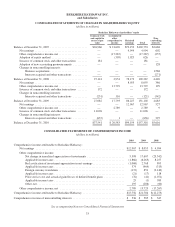

BERKSHIRE HATHAWAY INC.

and Subsidiaries

CONSOLIDATED BALANCE SHEETS

(dollars in millions)

December 31,

2010 2009

ASSETS

Insurance and Other:

Cash and cash equivalents ............................................................................ $ 34,767 $ 28,223

Investments:

Fixed maturity securities ......................................................................... 33,803 35,729

Equity securities ................................................................................ 59,819 56,562

Other ......................................................................................... 19,333 29,440

Receivables ........................................................................................ 20,917 14,792

Inventories ........................................................................................ 7,101 6,147

Property, plant and equipment ......................................................................... 15,741 15,720

Goodwill .......................................................................................... 27,891 27,614

Other ............................................................................................. 13,529 13,070

232,901 227,297

Railroad, Utilities and Energy:

Cash and cash equivalents ............................................................................ 2,557 429

Property, plant and equipment ......................................................................... 77,385 30,936

Goodwill .......................................................................................... 20,084 5,334

Other ............................................................................................. 13,579 8,072

113,605 44,771

Finance and Financial Products:

Cash and cash equivalents ............................................................................ 903 1,906

Investments in fixed maturity securities .................................................................. 1,080 1,402

Other investments ................................................................................... 3,676 3,160

Loans and finance receivables ......................................................................... 15,226 13,989

Goodwill .......................................................................................... 1,031 1,024

Other ............................................................................................. 3,807 3,570

25,723 25,051

$372,229 $297,119

LIABILITIES AND SHAREHOLDERS’ EQUITY

Insurance and Other:

Losses and loss adjustment expenses .................................................................... $ 60,075 $ 59,416

Unearned premiums ................................................................................. 7,997 7,925

Life, annuity and health insurance benefits ............................................................... 8,565 5,228

Accounts payable, accruals and other liabilities ........................................................... 15,826 15,530

Notes payable and other borrowings .................................................................... 12,471 4,561

104,934 92,660

Railroad, Utilities and Energy:

Accounts payable, accruals and other liabilities ........................................................... 12,367 5,895

Notes payable and other borrowings .................................................................... 31,626 19,579

43,993 25,474

Finance and Financial Products:

Accounts payable, accruals and other liabilities ........................................................... 1,168 937

Derivative contract liabilities .......................................................................... 8,371 9,269

Notes payable and other borrowings .................................................................... 14,477 13,769

24,016 23,975

Income taxes, principally deferred .......................................................................... 36,352 19,225

Total liabilities ............................................................................. 209,295 161,334

Shareholders’ equity:

Common stock ..................................................................................... 8 8

Capital in excess of par value .......................................................................... 37,533 27,074

Accumulated other comprehensive income ............................................................... 20,583 17,793

Retained earnings ................................................................................... 99,194 86,227

Berkshire Hathaway shareholders’ equity ........................................................ 157,318 131,102

Noncontrolling interests .............................................................................. 5,616 4,683

Total shareholders’ equity .................................................................... 162,934 135,785

$372,229 $297,119

See accompanying Notes to Consolidated Financial Statements

30