Berkshire Hathaway 2010 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion (Continued)

Finance and Financial Products (Continued)

Berkshire Hathaway Finance Corporation’s (“BHFC”) borrowings ($11.5 billion as of December 31, 2010), which are used in

connection with Clayton Homes’ installment lending activities. A corresponding charge is reflected in the manufactured housing

and finance earnings. Also included in other finance business activity is the guaranty fee of $38 million that was due from

NetJets in 2010. As previously discussed, NetJets recorded a corresponding charge to its 2010 earnings.

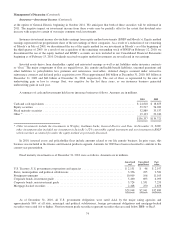

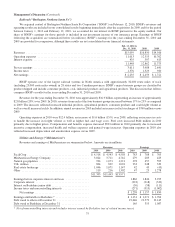

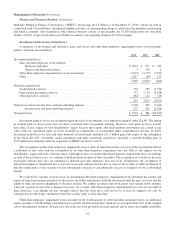

Investment and Derivative Gains/Losses

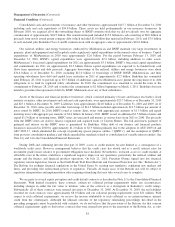

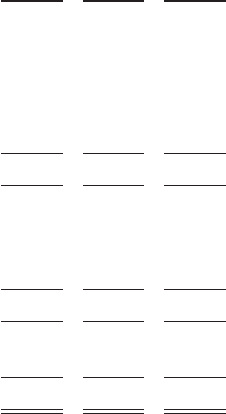

A summary of investment and derivative gains and losses and other-than-temporary impairment losses on investments

follows. Amounts are in millions.

2010 2009 2008

Investment gains/losses

Sales and other disposals of investments

Insurance and other ...................................................... $3,032 $ 277 $ 912

Finance and financial products .............................................. 9 110 6

Other-than-temporary impairment losses on investments ............................. (1,973) (3,155) (1,813)

Other ...................................................................... 1,017 (69) 255

2,085 (2,837) (640)

Derivative gains/losses

Credit default contracts ....................................................... 250 789 (1,774)

Equity index put option contracts ............................................... 172 2,713 (5,028)

Other derivative contracts ..................................................... (161) 122 (19)

261 3,624 (6,821)

Gains/losses before income taxes and noncontrolling interests ............................. 2,346 787 (7,461)

Income taxes and noncontrolling interests ..................................... 472 301 (2,816)

Net gains/losses ................................................................. $1,874 $ 486 $(4,645)

Investment gains or losses are recognized upon the sales of investments or as otherwise required under GAAP. The timing

of realized gains or losses from sales can have a material effect on periodic earnings. However, such gains or losses usually

have little, if any, impact on total shareholders’ equity because most equity and fixed maturity investments are carried at fair

value with any unrealized gains or losses included as components of accumulated other comprehensive income. In 2010,

investment gains/losses on sales and other disposals of investments included a $1.3 billion gain with respect to the redemption

of the Swiss Re 12% convertible capital instrument and other investment gains/losses included a one-time holding gain of

$979 million in connection with our acquisition of BNSF (see Notes 2 and 5).

The recognition of other-than-temporary impairment losses results in reductions in the cost basis of the investments but not

a reduction in fair value and the recognition of an other-than-temporary impairment loss has little if any impact on our

shareholders’ equity and book value per share. Although we have recorded other-than-temporary impairment losses in earnings

in each of the past three years, we continue to hold positions in many of these securities. The recognition of such losses does not

necessarily indicate that sales are imminent or planned and sales ultimately may not occur. Furthermore, the recognition of

other-than-temporary impairment losses does not necessarily indicate that the loss in value of the security is either permanent or

that the market price of the security will not subsequently increase to and ultimately exceed our original cost by a substantial

margin.

We collectively consider several factors in determining other-than-temporary impairment losses including the current and

expected long-term business prospects of the issuer, our ability and intent to hold the investment until the price recovers and the

length of time and relative magnitude of the price decline. We further recognize that stock prices may remain below intrinsic

value for a period of time that is deemed excessive. As a result, other-than-temporary impairment losses may be recorded in

these instances, even though we may strongly believe that the stock price will recover to at least its original cost and we

currently possess the ability and intent to hold the security until, at least, that time.

Other-than-temporary impairment losses recorded in the fourth quarter of 2010 included unrealized losses on individual

equity securities of $938 million (determined on a specific identification basis). Such losses averaged about 20% of the original

cost of the impaired securities. In each case, the issuer has been profitable in recent periods and in some cases highly profitable.

81