Berkshire Hathaway 2010 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Let me emphasize again that cost-free float is not an outcome to be expected for the P/C industry as a

whole: In most years, industry premiums have been inadequate to cover claims plus expenses. Consequently, the

industry’s overall return on tangible equity has for many decades fallen far short of the average return realized by

American industry, a sorry performance almost certain to continue. Berkshire’s outstanding economics exist only

because we have some terrific managers running some unusual businesses. We’ve already told you about GEICO,

but we have two other very large operations, and a bevy of smaller ones as well, each a star in its own way.

************

First off is the Berkshire Hathaway Reinsurance Group, run by Ajit Jain. Ajit insures risks that no one

else has the desire or the capital to take on. His operation combines capacity, speed, decisiveness and, most

importantly, brains in a manner that is unique in the insurance business. Yet he never exposes Berkshire to risks

that are inappropriate in relation to our resources. Indeed, we are far more conservative than most large insurers

in that respect. In the past year, Ajit has significantly increased his life reinsurance operation, developing annual

premium volume of about $2 billion that will repeat for decades.

From a standing start in 1985, Ajit has created an insurance business with float of $30 billion and

significant underwriting profits, a feat that no CEO of any other insurer has come close to matching. By his

accomplishments, he has added a great many billions of dollars to the value of Berkshire. Even kryptonite

bounces off Ajit.

************

We have another insurance powerhouse in General Re, managed by Tad Montross.

At bottom, a sound insurance operation requires four disciplines: (1) An understanding of all exposures

that might cause a policy to incur losses; (2) A conservative evaluation of the likelihood of any exposure actually

causing a loss and the probable cost if it does; (3) The setting of a premium that will deliver a profit, on average,

after both prospective loss costs and operating expenses are covered; and (4) The willingness to walk away if the

appropriate premium can’t be obtained.

Many insurers pass the first three tests and flunk the fourth. The urgings of Wall Street, pressures from

the agency force and brokers, or simply a refusal by a testosterone-driven CEO to accept shrinking volumes has

led too many insurers to write business at inadequate prices. “The other guy is doing it so we must as well” spells

trouble in any business, but none more so than insurance.

Tad has observed all four of the insurance commandments, and it shows in his results. General Re’s huge

float has been better than cost-free under his leadership, and we expect that, on average, it will continue to be.

************

Finally, we own a group of smaller companies, most of them specializing in odd corners of the

insurance world. In aggregate, their results have consistently been profitable and, as the table below shows, the

float they provide us is substantial. Charlie and I treasure these companies and their managers.

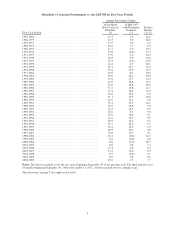

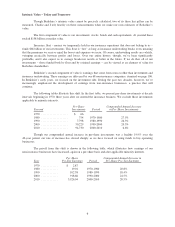

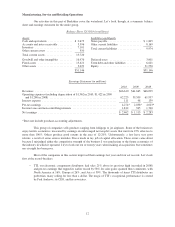

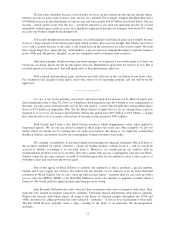

Here is the record of all four segments of our property-casualty and life insurance businesses:

Underwriting Profit Yearend Float

(in millions)

Insurance Operations 2010 2009 2010 2009

General Re ...................... $ 452 $ 477 $20,049 $21,014

BH Reinsurance .................. 176 250 30,370 27,753

GEICO ......................... 1,117 649 10,272 9,613

Other Primary ................... 268 84 5,141 5,061

$2,013 $1,460 $65,832 $63,441

Among large insurance operations, Berkshire’s impresses me as the best in the world.

11