Berkshire Hathaway 2010 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements (Continued)

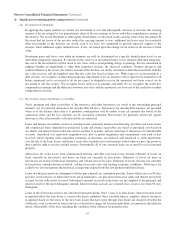

(1) Significant accounting policies and practices (Continued)

(t) New accounting pronouncements (Continued)

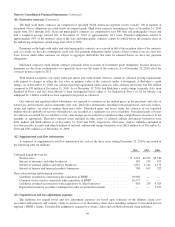

In January 2010, the FASB issued ASU 2010-06, “Improving Disclosures About Fair Value Measurements.” ASU

2010-06 requires the separate disclosure of significant transfers into and out of the Level 1 and Level 2 categories;

requires fair value measurement disclosures for each class of assets and liabilities; and requires disclosures about

valuation techniques and inputs used in Level 2 and Level 3 fair value measurements. These disclosure requirements

became effective at the beginning of 2010. In addition, effective in fiscal years beginning after December 15, 2010,

ASU 2010-06 also requires Level 3 disclosures of activity on a gross rather than a net basis. We do not anticipate that

the remaining disclosures under ASU 2010-06 will have a material impact on our Consolidated Financial Statements.

In July 2010, the FASB issued ASU 2010-20, “Disclosures about the Credit Quality of Financing Receivables and

the Allowance for Credit Losses.” ASU 2010-20 requires increased disclosures about the credit quality of financing

receivables and allowances for credit losses, including disclosure about credit quality indicators, past due

information and modifications of finance receivables. The guidance regarding end of period reporting is effective

for reporting periods ending after December 15, 2010, while guidance about activity during the reporting period is

effective for reporting periods beginning after December 15, 2010, except for guidance regarding loan

modifications, which has been delayed. We do not anticipate that the adoption of ASU 2010-20 will have a material

impact on our Consolidated Financial Statements.

In October 2010, the FASB issued ASU 2010-26, “Accounting for Costs Associated with Acquiring or Renewing

Insurance Contracts.” ASU 2010-26 modifies the types of costs incurred by insurance entities that are deferred in

the acquiring or renewing of insurance contracts. ASU 2010-26 requires that only direct incremental costs related

to successful efforts are capitalized. Capitalized costs may include certain advertising costs which are allowed

to be capitalized if the primary purpose of the advertising is to elicit sales to customers proven to have responded

directly to the advertising and the probable future revenues generated from the advertising are proven to be in

excess of expected future costs to be incurred in realizing those revenues. ASU 2010-26 is effective for fiscal

years and interim periods beginning after December 15, 2011 and may be applied on a prospective or retrospective

basis. We are evaluating the effect that the adoption of ASU 2010-26 will have on our Consolidated Financial

Statements.

In December 2010, the FASB issued ASU 2010-28, “When to Perform Step 2 of the Goodwill Impairment Test for

Reporting Units with Zero or Negative Carrying Amounts.” ASU 2010-28 modifies Step 1 of the goodwill

impairment test for reporting units with zero or negative carrying amounts. For those reporting units, Step 2 of the

goodwill impairment test is required if it is more likely than not that a goodwill impairment exists, after

considering whether there are any adverse qualitative factors indicating that an impairment may exist. ASU

2010-28 is effective prospectively for fiscal years and interim periods beginning after December 15, 2011. We do

not anticipate the adoption of ASU 2010-28 will have a material impact on our Consolidated Financial Statements.

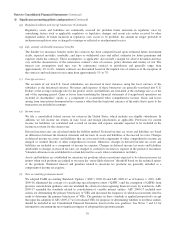

(2) Significant business acquisitions

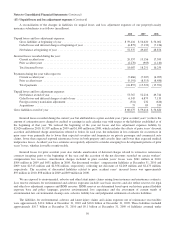

Our long-held acquisition strategy is to purchase businesses with consistent earning power, good returns on equity and able

and honest management at sensible prices.

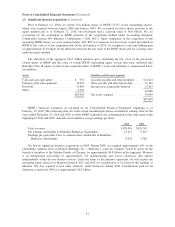

On February 12, 2010, we acquired all of the outstanding common stock of the Burlington Northern Santa Fe

Corporation that we did not already own (about 264.5 million shares or 77.5%) for aggregate consideration of $26.5 billion

that consisted of cash of approximately $15.9 billion with the remainder in Berkshire common stock (80,931 Class A shares

and 20,976,621 Class B shares). Approximately 50% of the cash component was funded with existing cash balances and the

remaining 50% was funded with proceeds from debt issued by Berkshire. The acquisition was completed through the merger

of a wholly-owned merger subsidiary (a Delaware limited liability company) and Burlington Northern Santa Fe Corporation.

The merger subsidiary was the surviving entity and was renamed Burlington Northern Santa Fe, LLC (“BNSF”). BNSF is

based in Fort Worth, Texas, and through BNSF Railway Company operates one of the largest railroad systems in North

America with approximately 32,000 route miles (including 23,000 route miles of track owned by BNSF) of track in 28 states

and two Canadian provinces.

40