Berkshire Hathaway 2010 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

But a house can be a nightmare if the buyer’s eyes are bigger than his wallet and if a lender – often

protected by a government guarantee – facilitates his fantasy. Our country’s social goal should not be to put

families into the house of their dreams, but rather to put them into a house they can afford.

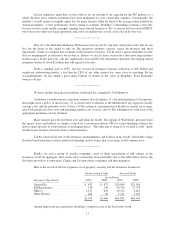

Investments

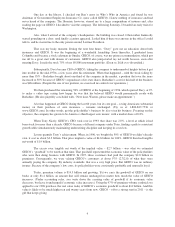

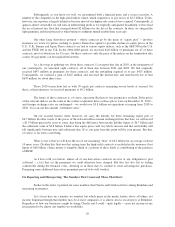

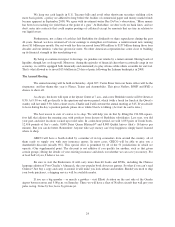

Below we show our common stock investments that at yearend had a market value of more than

$1 billion.

12/31/10

Shares Company

Percentage of

Company

Owned Cost * Market

(in millions)

151,610,700 American Express Company ........................ 12.6 $ 1,287 $ 6,507

225,000,000 BYD Company, Ltd. .............................. 9.9 232 1,182

200,000,000 The Coca-Cola Company .......................... 8.6 1,299 13,154

29,109,637 ConocoPhillips .................................. 2.0 2,028 1,982

45,022,563 Johnson & Johnson ............................... 1.6 2,749 2,785

97,214,584 Kraft Foods Inc. ................................. 5.6 3,207 3,063

19,259,600 Munich Re ...................................... 10.5 2,896 2,924

3,947,555 POSCO ........................................ 4.6 768 1,706

72,391,036 The Procter & Gamble Company .................... 2.6 464 4,657

25,848,838 Sanofi-Aventis .................................. 2.0 2,060 1,656

242,163,773 Tesco plc ....................................... 3.0 1,414 1,608

78,060,769 U.S. Bancorp .................................... 4.1 2,401 2,105

39,037,142 Wal-Mart Stores, Inc. ............................. 1.1 1,893 2,105

358,936,125 Wells Fargo & Company .......................... 6.8 8,015 11,123

Others ......................................... 3,020 4,956

Total Common Stocks Carried at Market .............. $33,733 $61,513

*This is our actual purchase price and also our tax basis; GAAP “cost” differs in a few cases because of

write-ups or write-downs that have been required.

In our reported earnings we reflect only the dividends our portfolio companies pay us. Our share of the

undistributed earnings of these investees, however, was more than $2 billion last year. These retained earnings

are important. In our experience – and, for that matter, in the experience of investors over the past century –

undistributed earnings have been either matched or exceeded by market gains, albeit in a highly irregular manner.

(Indeed, sometimes the correlation goes in reverse. As one investor said in 2009: “This is worse than divorce.

I’ve lost half my net worth – and I still have my wife.”) In the future, we expect our market gains to eventually at

least equal the earnings our investees retain.

************

In our earlier estimate of Berkshire’s normal earning power, we made three adjustments that relate to

future investment income (but did not include anything for the undistributed earnings factor I have just

described).

The first adjustment was decidedly negative. Last year, we discussed five large fixed-income

investments that have been contributing substantial sums to our reported earnings. One of these – our Swiss Re

note – was redeemed in the early days of 2011, and two others – our Goldman Sachs and General Electric

preferred stocks – are likely to be gone by yearend. General Electric is entitled to call our preferred in October

and has stated its intention to do so. Goldman Sachs has the right to call our preferred on 30 days notice, but has

been held back by the Federal Reserve (bless it!), which unfortunately will likely give Goldman the green light

before long.

17