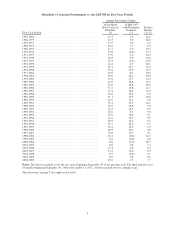

Berkshire Hathaway 2010 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Intrinsic Value – Today and Tomorrow

Though Berkshire’s intrinsic value cannot be precisely calculated, two of its three key pillars can be

measured. Charlie and I rely heavily on these measurements when we make our own estimates of Berkshire’s

value.

The first component of value is our investments: stocks, bonds and cash equivalents. At yearend these

totaled $158 billion at market value.

Insurance float – money we temporarily hold in our insurance operations that does not belong to us –

funds $66 billion of our investments. This float is “free” as long as insurance underwriting breaks even, meaning

that the premiums we receive equal the losses and expenses we incur. Of course, underwriting results are volatile,

swinging erratically between profits and losses. Over our entire history, though, we’ve been significantly

profitable, and I also expect us to average breakeven results or better in the future. If we do that, all of our

investments – those funded both by float and by retained earnings – can be viewed as an element of value for

Berkshire shareholders.

Berkshire’s second component of value is earnings that come from sources other than investments and

insurance underwriting. These earnings are delivered by our 68 non-insurance companies, itemized on page 106.

In Berkshire’s early years, we focused on the investment side. During the past two decades, however, we’ve

increasingly emphasized the development of earnings from non-insurance businesses, a practice that will

continue.

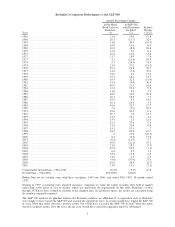

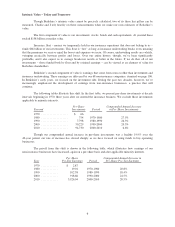

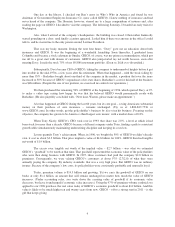

The following tables illustrate this shift. In the first table, we present per-share investments at decade

intervals beginning in 1970, three years after we entered the insurance business. We exclude those investments

applicable to minority interests.

Yearend

Per-Share

Investments Period

Compounded Annual Increase

in Per-Share Investments

1970 ................... $ 66

1980 ................... 754 1970-1980 27.5%

1990 ................... 7,798 1980-1990 26.3%

2000 ................... 50,229 1990-2000 20.5%

2010 ................... 94,730 2000-2010 6.6%

Though our compounded annual increase in per-share investments was a healthy 19.9% over the

40-year period, our rate of increase has slowed sharply as we have focused on using funds to buy operating

businesses.

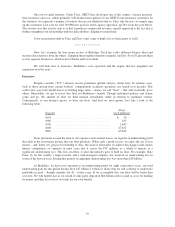

The payoff from this shift is shown in the following table, which illustrates how earnings of our

non-insurance businesses have increased, again on a per-share basis and after applicable minority interests.

Year

Per-Share

Pre-Tax Earnings Period

Compounded Annual Increase in

Per-Share Pre-Tax Earnings

1970 ............ $ 2.87

1980 ............ 19.01 1970-1980 20.8%

1990 ............ 102.58 1980-1990 18.4%

2000 ............ 918.66 1990-2000 24.5%

2010 ............ 5,926.04 2000-2010 20.5%

6