Berkshire Hathaway 2010 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

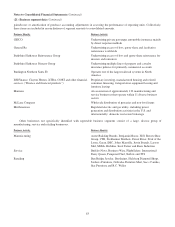

Management’s Discussion (Continued)

Insurance—Underwriting (Continued)

Berkshire Hathaway Primary Group

Our primary insurance group consists of a wide variety of independently managed insurance businesses that principally

write liability coverages for commercial accounts. These businesses include: Medical Protective Corporation (“MedPro”), a

provider of professional liability insurance to physicians, dentists and other healthcare providers; National Indemnity

Company’s primary group (“NICO Primary Group”), writers of commercial motor vehicle and general liability coverages; U.S.

Investment Corporation, whose subsidiaries underwrite specialty insurance coverages; a group of companies referred to

internally as “Berkshire Hathaway Homestate Companies,” providers of standard commercial multi-line insurance; Central

States Indemnity Company, a provider of credit and disability insurance to individuals nationwide through financial institutions;

Applied Underwriters, a provider of integrated workers’ compensation solutions; and BoatU.S., a writer of insurance for owners

of boats and small watercraft.

Earned premiums by our primary insurance businesses were $1.7 billion in 2010, $1.8 billion in 2009 and $2.0 billion in

2008. Premium volume of our primary insurers, in general, has been and continues to be constrained by soft market conditions

and as a result, we are accepting less business. Underwriting gains as percentages of premiums earned were approximately 16%

in 2010, 5% in 2009 and 11% in 2008. The improvement in underwriting results was primarily due to reductions of MedPro’s

estimated prior years’ loss reserves and lower loss ratios of the Berkshire Hathaway Homestate Companies.

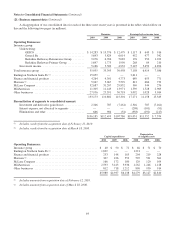

Insurance—Investment Income

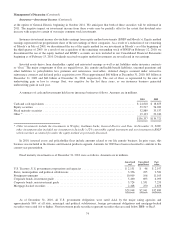

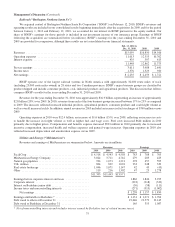

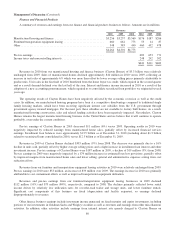

A summary of net investment income of our insurance operations follows. Amounts are in millions.

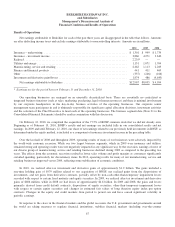

2010 2009 2008

Investment income before taxes, noncontrolling interests and equity method earnings ............ $5,145 $5,459 $4,896

Income taxes and noncontrolling interests ............................................... 1,335 1,615 1,286

Net investment income before equity method earnings ..................................... 3,810 3,844 3,610

Equity method earnings ............................................................. 50 427 —

Net investment income .............................................................. $3,860 $4,271 $3,610

Investment income consists of interest and dividends earned on cash and cash equivalents and investments attributable to

our insurance businesses. Pre-tax investment income declined $314 million (5.8%) compared with 2009. The decline in 2010

investment income reflected lower dividends earned from our investments in Wells Fargo common stock and the impact of a

realized gain in 2009 of about $100 million from a short-term currency transaction made in anticipation of our investment in the

Swiss Re convertible capital instrument.

Pre-tax investment income in 2009 exceeded 2008 by $563 million (11.5%). The increase in investment income in 2009

primarily reflected earnings from several large investments made in the fourth quarter of 2008 and first half of 2009, partially

offset by lower earnings on cash and cash equivalents due to lower short-term interest rates and lower average cash balances.

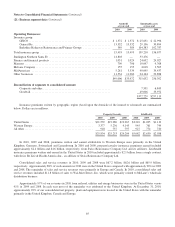

In October 2008, we acquired 11.45% subordinated notes and 5% preferred stock issued by Wrigley and preferred stocks

of Goldman Sachs and General Electric that each pay an annual dividend of 10%. In March 2009, we acquired a 12%

convertible capital instrument of Swiss Re and in April 2009, we acquired an 8.5% Cumulative Convertible Perpetual Preferred

Stock of Dow. In December 2009, we also acquired $1.0 billion par amount of senior notes issued by Wrigley. Approximately

85% of these securities were acquired by our insurance group, with the remainder primarily held in our finance and financial

products businesses. Our insurance group earned about $1.8 billion in 2010 and $1.7 billion in 2009 in interest and dividends

from the aforementioned investments.

Our investment income in 2011 may decline as compared to 2010 as a result of maturities and redemptions of higher

yielding investments that occurred in 2010 and are expected to occur in 2011 and low interest rates currently available for

reinvestment purposes. As a result, our cash and cash equivalent balances will likely increase during 2011. In November 2010,

an agreement was entered into with Swiss Re providing for the redemption of the 12% capital instrument for aggregate

consideration of approximately CHF 3.9 billion. In addition, our investment in Goldman Sachs preferred stock may be

redeemed at the option of Goldman Sachs at any time and our investment in General Electric preferred stock may be redeemed

73