Berkshire Hathaway 2010 Annual Report Download - page 23

Download and view the complete annual report

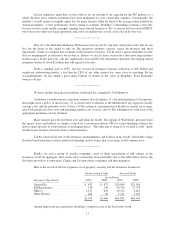

Please find page 23 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We have that flexibility because realized gains or losses on investments go into the net income figure,

whereas unrealized gains (and, in most cases, losses) are excluded. For example, imagine that Berkshire had a

$10 billion increase in unrealized gains in a given year and concurrently had $1 billion of realized losses. Our net

income – which would count only the loss – would be reported as less than our operating income. If we had

meanwhile realized gains in the previous year, headlines might proclaim that our earnings were down X% when

in reality our business might be much improved.

If we really thought net income important, we could regularly feed realized gains into it simply because

we have a huge amount of unrealized gains upon which to draw. Rest assured, though, that Charlie and I have

never sold a security because of the effect a sale would have on the net income we were soon to report. We both

have a deep disgust for “game playing” with numbers, a practice that was rampant throughout corporate America

in the 1990s and still persists, though it occurs less frequently and less blatantly than it used to.

Operating earnings, despite having some shortcomings, are in general a reasonable guide as to how our

businesses are doing. Ignore our net income figure, however. Regulations require that we report it to you. But if

you find reporters focusing on it, that will speak more to their performance than ours.

Both realized and unrealized gains and losses are fully reflected in the calculation of our book value.

Pay attention to the changes in that metric and to the course of our operating earnings, and you will be on the

right track.

************

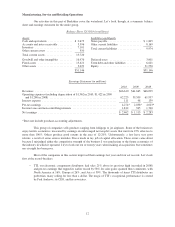

As a p.s., I can’t resist pointing out just how capricious reported net income can be. Had our equity puts

had a termination date of June 30, 2010, we would have been required to pay $6.4 billion to our counterparties at

that date. Security prices then generally rose in the next quarter, a move that brought the corresponding figure

down to $5.8 billion on September 30th. Yet the Black-Scholes formula that we use in valuing these contracts

required us to increase our balance-sheet liability during this period from $8.9 billion to $9.6 billion, a change

that, after the effect of tax accruals, reduced our net income for the quarter by $455 million.

Both Charlie and I believe that Black-Scholes produces wildly inappropriate values when applied to

long-dated options. We set out one absurd example in these pages two years ago. More tangibly, we put our

money where our mouth was by entering into our equity put contracts. By doing so, we implicitly asserted that

the Black-Scholes calculations used by our counterparties or their customers were faulty.

We continue, nevertheless, to use that formula in presenting our financial statements. Black-Scholes is

the accepted standard for option valuation – almost all leading business schools teach it – and we would be

accused of shoddy accounting if we deviated from it. Moreover, we would present our auditors with an

insurmountable problem were we to do that: They have clients who are our counterparties and who use Black-

Scholes values for the same contracts we hold. It would be impossible for our auditors to attest to the accuracy of

both their values and ours were the two far apart.

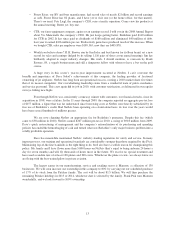

Part of the appeal of Black-Scholes to auditors and regulators is that it produces a precise number.

Charlie and I can’t supply one of those. We believe the true liability of our contracts to be far lower than that

calculated by Black-Scholes, but we can’t come up with an exact figure – anymore than we can come up with a

precise value for GEICO, BNSF, or for Berkshire Hathaway itself. Our inability to pinpoint a number doesn’t

bother us: We would rather be approximately right than precisely wrong.

John Kenneth Galbraith once slyly observed that economists were most economical with ideas: They

made the ones learned in graduate school last a lifetime. University finance departments often behave similarly.

Witness the tenacity with which almost all clung to the theory of efficient markets throughout the 1970s and

1980s, dismissively calling powerful facts that refuted it “anomalies.” (I always love explanations of that kind:

The Flat Earth Society probably views a ship’s circling of the globe as an annoying, but inconsequential,

anomaly.)

21