Berkshire Hathaway 2010 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

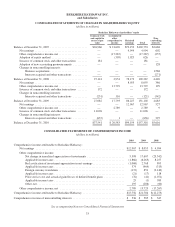

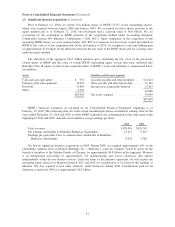

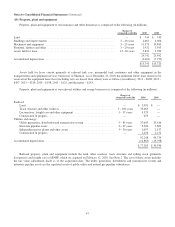

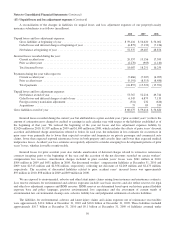

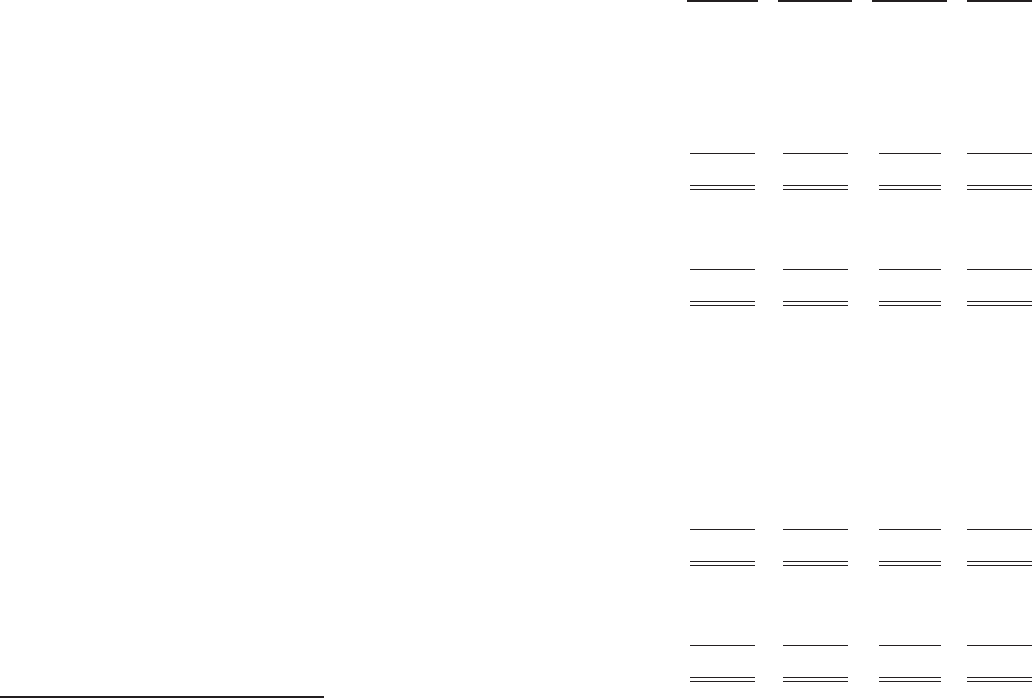

(4) Investments in equity securities

Investments in equity securities as of December 31, 2010 and 2009 are summarized below (in millions).

Cost Basis

Unrealized

Gains

Unrealized

Losses

Fair

Value

December 31, 2010

American Express Company ........................................... $ 1,287 $ 5,220 $ — $ 6,507

The Coca-Cola Company .............................................. 1,299 11,855 — 13,154

The Procter & Gamble Company ........................................ 4,321 336 — 4,657

Wells Fargo & Company .............................................. 8,015 3,521 (413) 11,123

Other .............................................................. 20,622 5,709 (259) 26,072

$35,544 $26,641 $ (672) $61,513

Insurance and other .................................................. $34,875 $25,616 $ (672) $59,819

Railroad, utilities and energy * ......................................... 232 950 — 1,182

Finance and financial products * ........................................ 437 75 — 512

$35,544 $26,641 $ (672) $61,513

December 31, 2009

American Express Company ........................................... $ 1,287 $ 4,856 $ — $ 6,143

The Coca-Cola Company .............................................. 1,299 10,101 — 11,400

The Procter & Gamble Company ........................................ 4,962 78 — 5,040

Wells Fargo & Company .............................................. 7,394 2,721 (1,094) 9,021

Other .............................................................. 22,265 7,118 (1,953) 27,430

$37,207 $24,874 $(3,047) $59,034

Insurance and other .................................................. $36,538 $23,070 $(3,046) $56,562

Railroad, utilities and energy * ......................................... 232 1,754 — 1,986

Finance and financial products * ........................................ 437 50 (1) 486

$37,207 $24,874 $(3,047) $59,034

* Included in Other assets.

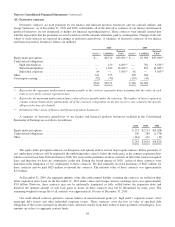

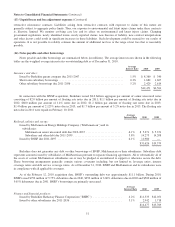

Unrealized losses of equity investments at December 31, 2010 that were in a continuous loss position for more than twelve

months and for which other-than-temporary impairment charges were not recorded were $531 million, including $384 million

related to Wells Fargo & Company. As of December 31, 2009, unrealized losses over one year in duration were approximately

$2.7 billion, including $832 million related to Wells Fargo & Company. As of December 31, 2010, such losses generally ranged

between 3% and 15% of the original cost of the related individual securities. We believe that the impairment of each of the

individual securities that have been in an unrealized loss position over twelve months as of December 31, 2010 is temporary.

Our belief is based on (a) our ability and current intent to hold the securities to recovery; (b) our assessment that the underlying

business and financial condition of the issuers improved over the past year and that such conditions are currently favorable;

(c) our opinion that the relative price declines are not significant; (d) the fact that the market prices of these issuers have

increased over the past year; and (e) our belief that it is reasonably possible that market prices will increase to and exceed our

cost in a relatively short period of time. Changes in market conditions and other facts and circumstances may change the

business prospects of these issuers as well as our ability and current intent to hold these securities until the prices recover.

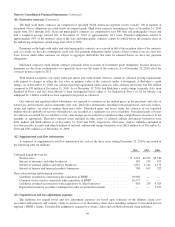

During the fourth quarter of 2010, we recorded other-than-temporary impairment losses of $938 million related to certain

other equity securities. These securities had been in unrealized loss positions for over two years. The amount of the impairments

averaged about 20% of the original cost of each security. Other-than-temporary impairment losses result in a reduction of the

cost basis of the investment but not the fair value. Accordingly, such losses that are included in earnings are offset by a

corresponding credit to other comprehensive income.

43