Berkshire Hathaway 2010 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

(17) Fair value measurements (Continued)

price, expected volatility, dividend and interest rates and contract duration. Credit default contracts are primarily valued

based on indications of bid or offer data as of the balance sheet date. These contracts are not exchange traded and certain of

the terms of our contracts are not standard in derivatives markets. For example, we are not required to post collateral under

most of our contracts. For these reasons, we classified these contracts as Level 3.

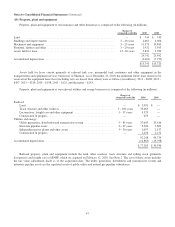

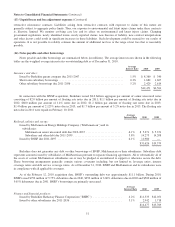

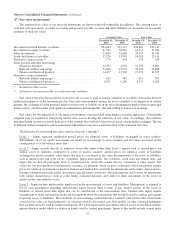

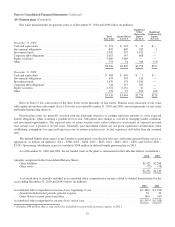

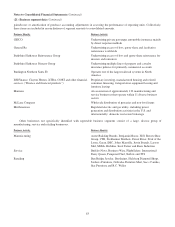

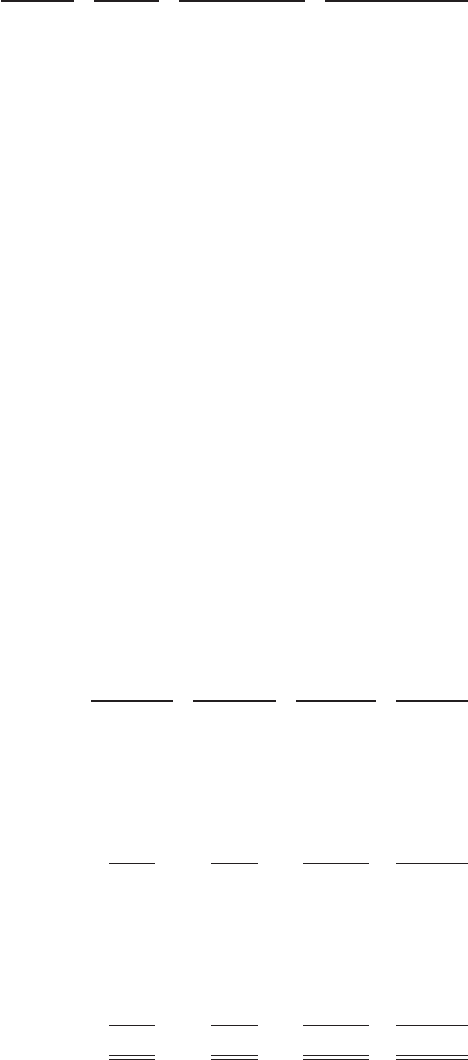

Financial assets and liabilities measured and carried at fair value on a recurring basis in our financial statements are

summarized according to the hierarchy previously described as follows (in millions).

Total

Fair Value

Quoted

Prices

(Level 1)

Significant Other

Observable Inputs

(Level 2)

Significant

Unobservable Inputs

(Level 3)

December 31, 2010

Investments in fixed maturity securities:

U.S. Treasury, U.S. government corporations and

agencies ..................................... $ 2,197 $ 535 $ 1,658 $ 4

States, municipalities and political subdivisions ........ 3,581 — 3,581 —

Foreign governments ............................. 11,912 5,633 6,167 112

Corporate bonds ................................. 14,054 23 13,346 685

Mortgage-backed securities ........................ 3,139 — 3,139 —

Investments in equity securities ......................... 61,513 61,390 88 35

Other investments ................................... 17,589 — — 17,589

Net derivative contract (assets)/liabilities:

Railroad, utilities and energy ....................... 390 7 52 331

Finance and financial products:

Equity index put options ...................... 6,712 — — 6,712

Credit default obligations ..................... 1,239 — — 1,239

Other ..................................... 77 — 137 (60)

December 31, 2009

Investments in fixed maturity securities .................. $37,131 $ 5,407 $30,806 $ 918

Investments in equity securities ......................... 59,034 58,640 90 304

Other investments ................................... 20,614 — — 20,614

Net derivative contract (assets)/liabilities:

Railroad, utilities and energy ....................... 393 (1) 35 359

Finance and financial products ..................... 9,003 — 166 8,837

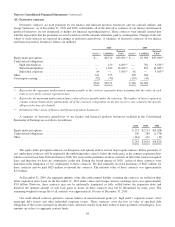

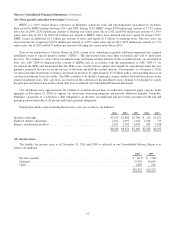

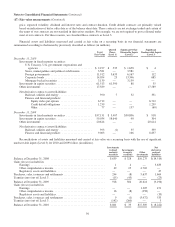

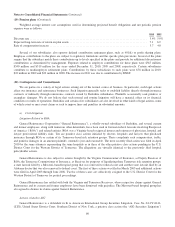

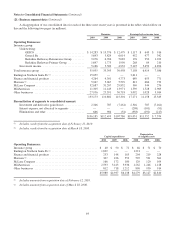

Reconciliations of assets and liabilities measured and carried at fair value on a recurring basis with the use of significant

unobservable inputs (Level 3) for 2010 and 2009 follow (in millions).

Investments

in fixed

maturity

securities

Investments

in equity

securities

Other

investments

Net

derivative

contract

liabilities

Balance at December 31, 2008 ...................................... $639 $328 $10,275 $(14,519)

Gains (losses) included in:

Earnings .................................................... 1 4 — 3,635

Other comprehensive income ................................... 49 25 4,702 —

Regulatory assets and liabilities .................................. — — — 47

Purchases, sales, issuances and settlements ............................. 244 (8) 5,637 1,664

Transfers into (out of) Level 3 ....................................... (15) (45) — (23)

Balance at December 31, 2009 ...................................... 918 304 20,614 (9,196)

Gains (losses) included in:

Earnings .................................................... — — 1,305 471

Other comprehensive income ................................... 16 (8) (358) —

Regulatory assets and liabilities .................................. — — — (33)

Purchases, sales, issuances and settlements ............................. 9 (1) (3,972) 533

Transfers into (out of) Level 3 ....................................... (142) (260) — 3

Balance at December 31, 2010 ...................................... $801 $ 35 $17,589 $ (8,222)

56