Berkshire Hathaway 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BERKSHIRE HATHAWAY INC.

and Subsidiaries

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

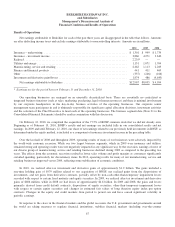

Results of Operations

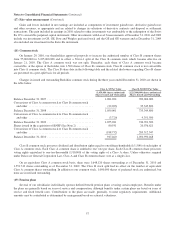

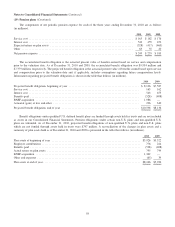

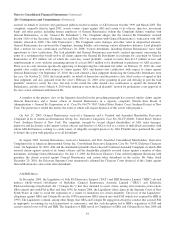

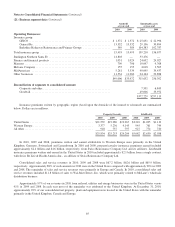

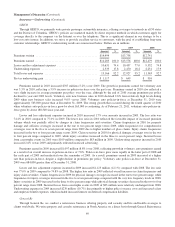

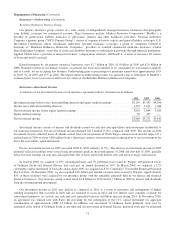

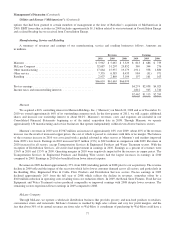

Net earnings attributable to Berkshire for each of the past three years are disaggregated in the table that follows. Amounts

are after deducting income taxes and exclude earnings attributable to noncontrolling interests. Amounts are in millions.

2010 2009 2008

Insurance – underwriting .......................................................... $ 1,301 $ 949 $ 1,739

Insurance – investment income ...................................................... 3,860 4,271 3,610

Railroad ........................................................................ 2,235* — —

Utilities and energy ............................................................... 1,131 1,071 1,704

Manufacturing, service and retailing ................................................. 2,462 1,113 2,283

Finance and financial products ...................................................... 441 411 469

Other .......................................................................... (337) (246) (166)

Investment and derivative gains/losses ................................................ 1,874 486 (4,645)

Net earnings attributable to Berkshire ............................................ $12,967 $8,055 $ 4,994

*Earnings are for the period between February 13 and December 31, 2010.

Our operating businesses are managed on an unusually decentralized basis. There are essentially no centralized or

integrated business functions (such as sales, marketing, purchasing, legal or human resources) and there is minimal involvement

by our corporate headquarters in the day-to-day business activities of the operating businesses. Our corporate senior

management team participates in and is ultimately responsible for significant capital allocation decisions, investment activities

and the selection of the Chief Executive to head each of the operating businesses. The business segment data (Note 21 to the

Consolidated Financial Statements) should be read in conjunction with this discussion.

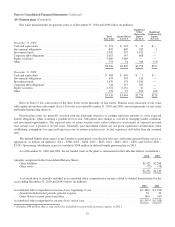

On February 12, 2010, we completed the acquisition of the 77.5% of BNSF common stock that we did not already own.

Beginning as of February 13, 2010, BNSF’s results and net earnings are included fully in our consolidated results and net

earnings. In 2009 and until February 12, 2010, our share of net earnings related to our previously held investments in BNSF, as

determined under the equity method, is included as a component of insurance investment income in the preceding table.

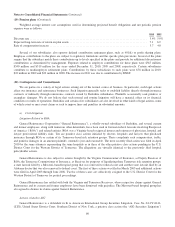

Over the last half of 2008 and throughout 2009, operating results of many of our businesses were adversely impacted by

the world-wide economic recession. While our two largest business segments, which in 2009 were insurance and utilities,

remained strong and operating results were not negatively impacted in any significant way by the recession, earnings of most of

our diverse group of manufacturing, service and retailing businesses declined during 2009 as compared to the preceding two

years. The effects from the economic recession resulted in lower sales volume and profit margins as consumers significantly

curtailed spending, particularly for discretionary items. In 2010, operating results for many of our manufacturing, service and

retailing businesses improved versus 2009, reflecting some stabilization of economic conditions.

In 2010, we realized after-tax investment and derivative gains of approximately $1.9 billion. The gains included a

one-time holding gain of $979 million related to our acquisition of BNSF, net realized gains from the dispositions of

investments, and net gains from derivative contracts, partially offset by non-cash other-than-temporary impairment losses

recorded with respect to certain fixed maturity and equity securities. In 2009, we realized after-tax investment and derivative

gains of $486 million, while in 2008 we had losses of approximately $4.6 billion. In 2009 and 2008, the gains and losses

primarily derived from credit default contracts, dispositions of equity securities, other-than-temporary impairment losses

with respect to certain equity securities and changes in estimated fair values of long duration equity index put option

contracts. Changes in the equity and credit markets from period to period can and have caused significant volatility in

periodic earnings.

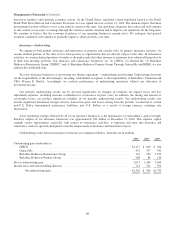

In response to the crises in the financial markets and the global recession, the U.S. government and governments around

the world are taking measures to regulate financial institutions, stabilize financial markets (including over-the-counter

67