Berkshire Hathaway 2010 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

(2) Significant business acquisitions (Continued)

Prior to February 12, 2010, we owned 76.8 million shares of BNSF (22.5% of the outstanding shares),

which were acquired between August 2006 and January 2009. We accounted for those shares pursuant to the

equity method and as of February 12, 2010, our investment had a carrying value of $6.6 billion. We are

accounting for the acquisition of BNSF pursuant to the acquisition method under Accounting Standards

Codification Section 805 Business Combinations (“ASC 805”). Upon completion of the acquisition of the

remaining BNSF shares, we were required under ASC 805 to re-measure our previously owned investment in

BNSF at fair value as of the acquisition date. In the first quarter of 2010, we recognized a one-time holding gain

of approximately $1.0 billion for the difference between the fair value of the BNSF shares and our carrying value

under the equity method.

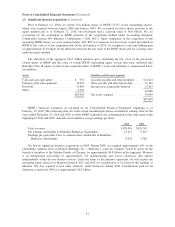

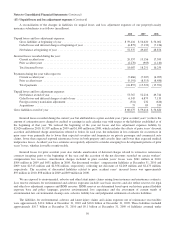

The allocation of the aggregate $34.5 billion purchase price (including the fair value of the previously

owned shares of BNSF and the value of certain BNSF outstanding equity awards that were converted into

Berkshire Class B equity awards on the acquisition date) to BNSF’s assets and liabilities is summarized below

(in millions):

Assets:

Cash and cash equivalents ............. $ 971

Property, plant and equipment .......... 43,987

Goodwill ........................... 14,803

Other .............................. 5,702

$65,463

Liabilities and Net assets acquired:

Accounts payable and other liabilities .... $ 6,623

Notes payable and other borrowings ..... 11,142

Income taxes, principally deferred ....... 13,203

30,968

Net assets acquired ................... 34,495

$65,463

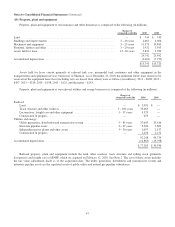

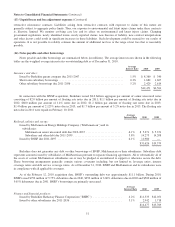

BNSF’s financial statements are included in our Consolidated Financial Statements beginning as of

February 13, 2010. The following table sets forth certain unaudited pro forma consolidated earnings data for the

years ended December 31, 2010 and 2009, as if the BNSF acquisition was consummated on the same terms at the

beginning of 2010 and 2009. Amounts are in millions, except earnings per share.

2010 2009

Total revenues .................................................. $138,004 $126,745

Net earnings attributable to Berkshire Hathaway shareholders ............ 13,213 9,525

Earnings per equivalent Class A common share attributable to Berkshire

Hathaway shareholders ......................................... 8,024 5,786

We had no significant business acquisitions in 2009. During 2008, we acquired approximately 64% of the

outstanding common stock of Marmon Holdings, Inc. (“Marmon”), a private company owned by trusts for the

benefit of members of the Pritzker Family of Chicago, for approximately $4.8 billion in the aggregate. Marmon

is an international association of approximately 130 manufacturing and service businesses that operate

independently within diverse business sectors. Under the terms of the purchase agreement, we will acquire the

remaining equity interests in Marmon between 2011 and 2014 for consideration to be based on the earnings of

Marmon. We also acquired several other relatively small businesses during 2008. Consideration paid for all

businesses acquired in 2008 was approximately $6.1 billion.

41